Last week, a new article was published revisiting the last days of the pro-crypto bank Silvergate, which allegedly was effectively shut down by federal regulators during the Biden administration. The events that took place in the spring of 2023 are widely misunderstood, and new information has shed light on what really happened. The conventional narrative suggests that Silvergate and other pro-crypto banks were responsible for their own downfall by accepting crypto firms as clients and mismanaging their asset portfolios during a turbulent time for the crypto industry. However, there is evidence to suggest that Silvergate and Signature were actually targeted and shut down as part of a coordinated effort to de-bank the crypto industry.

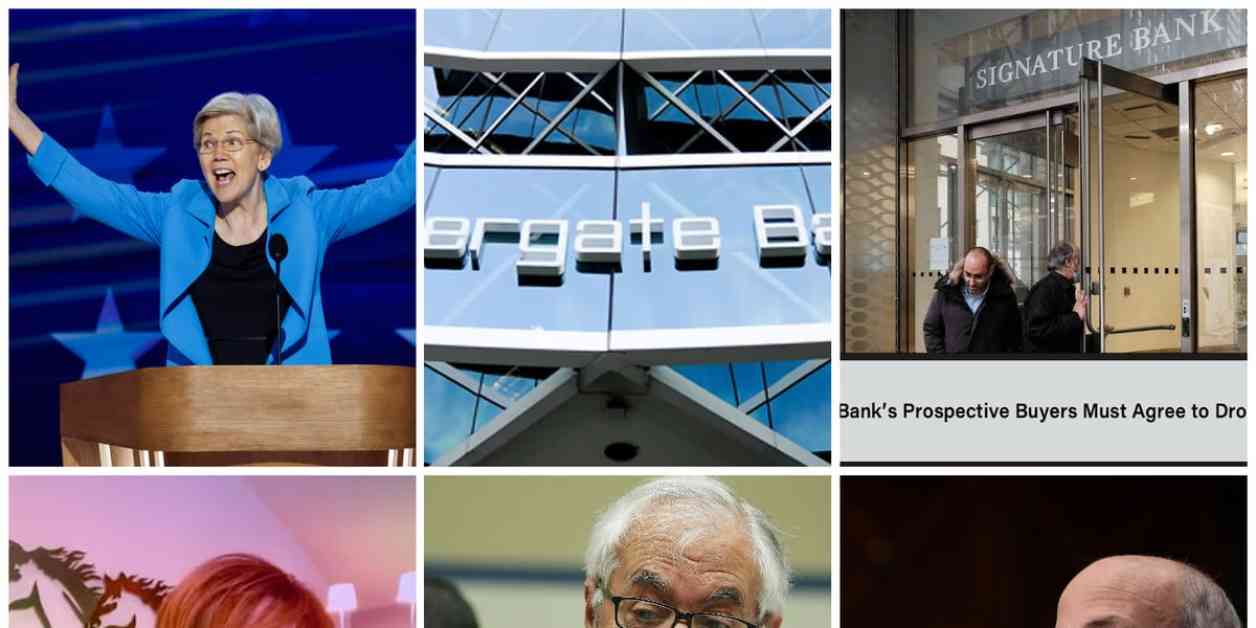

During the 2023 banking crisis, the Biden administration took drastic measures to discourage banks from serving the crypto industry, leading to the closure of two critical banks, Silvergate and Signature. Signature board member Barney Frank even suggested that the bank was shut down due to its association with crypto. The process of selling Signature was marred by irregularities, with the FDIC refusing to allow certain transactions related to crypto firms. Similarly, Silvergate was forced to liquidate by management after being instructed to reduce their crypto deposits significantly, making their business model unsustainable.

The allegations of criminality surrounding Silvergate and Signature during the crisis turned out to be baseless, as no criminal charges were ever brought against them. New filings from Silvergate indicate that they were essentially liquidated due to regulatory pressure, rather than any illegal activities. Since the crisis, bank regulators have continued to target banks serving the crypto industry, creating a hostile environment for such institutions.

The crackdown on crypto through financial regulation has been extensive, with various U.S. financial regulators imposing restrictions on banks dealing with crypto. This has made it incredibly challenging for U.S.-based crypto entrepreneurs to obtain banking services. The issue goes beyond crypto, raising questions about the government’s use of banking infrastructure for political purposes and the lack of transparency in regulatory actions.

The issue of banks being pressured to disassociate from certain industries without proper legal procedures raises concerns about due process and regulatory overreach. Banking infrastructure should remain neutral and accessible to all legal businesses, without being weaponized for political agendas. The partisan nature of these actions highlights the need for greater accountability and transparency in regulatory decisions that impact industries and businesses.

In conclusion, the targeting of pro-crypto banks like Silvergate and Signature represents a concerning trend of using regulatory power to stifle certain industries. The implications of these actions extend beyond the crypto sector and raise important questions about the role of government in regulating businesses. It is essential to uphold due process and fairness in regulatory actions to ensure a level playing field for all businesses.