Australia’s Monochrome Asset Management is all set to release the country’s first spot Ethereum exchange-traded fund on Tuesday. The Ethereum (ETH) ETF, with the ticker IETH, will be launched on the Cboe Australia on October 15th.

This move comes shortly after Monochrome introduced its spot Bitcoin (BTC) ETF back in August. The Monochrome Bitcoin ETF (IBTC) currently holds about 167 Bitcoin, valued at AUD 15 million.

Monochrome, along with Vasco Trustees Limited, submitted an application for the listing of IETH on the Cboe Australia in early September. The spot Ethereum ETF will passively hold Ether, providing retail investors with a regulated way to gain exposure to the world’s second-largest cryptocurrency by market capitalization, valued at over $316 billion.

IETH is a dual-access fund, allowing investors to redeem in both cash and in-kind. This means investors can buy and cash out of the ETF using the underlying asset, Ether. State Street Australia will act as the fund’s administrator, while digital assets custody provider BitGo and crypto exchange Gemini will serve as the custody services providers.

In the United States, the Securities and Exchange Commission (SEC) approved the first spot crypto ETFs in January 2024. This approval paved the way for funds like spot Bitcoin ETFs by BlackRock, Fidelity Investments, and Grayscale. The SEC later approved spot Ethereum ETFs in May, with trading commencing in July. Countries like Hong Kong and Australia have also given the green light to spot crypto ETFs.

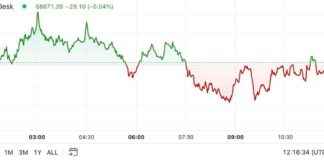

Although the total value of assets held in these funds in countries like Australia is relatively small, the demand in the U.S. market has been on the rise. Data from ETF tracking site SoSoValue shows that as of October 11th, the total net assets in U.S.-listed spot Bitcoin ETFs amounted to $58.66 billion, while Ethereum ETFs held $6.74 billion.

The introduction of the spot Ethereum ETF in Australia marks a significant step towards providing investors with more opportunities to diversify their portfolios and gain exposure to the growing cryptocurrency market. With the increasing acceptance of digital assets globally, it will be interesting to see how this new investment vehicle performs in the Australian market and how it impacts the broader financial landscape.