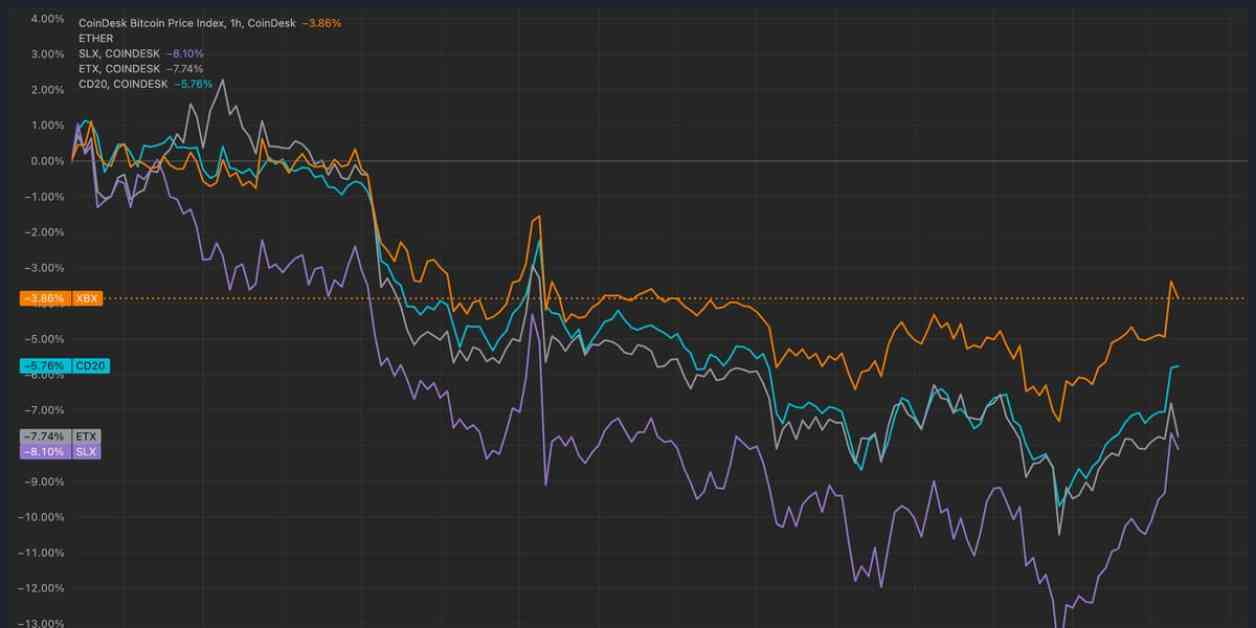

Bitcoin’s dominance in the cryptocurrency market has reached its highest level since April 2021, standing at 60.6%. This surge in dominance has been accompanied by a struggle for smaller cryptocurrencies, such as Ethereum (ETH) and Solana (SOL), as they underperformed during a recent market pullback. While Bitcoin saw a modest 4% decline from its recent peak of over $73,000, large-cap altcoins like ETH and SOL experienced a more significant drop of nearly 10% from their recent highs.

The broader market, as represented by the CoinDesk 20, also declined by almost 6%. Smaller cryptocurrencies fared even worse, with the combined market capitalization of altcoins outside of the top 10 largest cryptos hitting a low relative to Bitcoin not seen since early 2021. This price action has propelled Bitcoin’s market cap dominance to its current level.

Analysts at Bitfinex have noted that altcoins are struggling to keep up with Bitcoin in terms of capital inflow. Without a significant catalyst, the prospects for altcoins to make a comeback in the near future appear slim. Speculative interest that previously supported altcoin outperformance has diminished, and funding rates on perpetual futures markets have normalized.

Regulatory uncertainty has also played a role in the underperformance of altcoins. The results of the U.S. election and the perceived outlook for digital asset regulations are expected to have a more significant impact on smaller cryptocurrencies than on Bitcoin. K33 Research pointed out that Bitcoin’s attributes and wide availability position it to thrive in the medium term, regardless of the election outcome, while altcoins may be more sensitive to the election results.

However, David Duong, the head of research at Coinbase, remains optimistic about the future of altcoins. He believes that the elections and the uncertainty surrounding them could serve as an inflection point for altcoins to start catching up with Bitcoin. Duong expects Bitcoin dominance to plateau as investors turn their attention to altcoin names. He anticipates that the favorable macroeconomic conditions will provide a tailwind for the entire digital asset class, including altcoins.

In conclusion, while Bitcoin’s dominance over the cryptocurrency market remains strong, there is a possibility that altcoins could rally in the near future. The outcome of the U.S. election, regulatory developments, and macroeconomic factors will all play a role in shaping the performance of altcoins relative to Bitcoin. Investors should keep a close eye on these factors as they navigate the volatile cryptocurrency market.