Bitcoin reached a new all-time high of $88,448, showing an 11% surge in the past 24 hours. This surge in price has had a positive impact on the crypto market, with other cryptocurrencies like Ethereum and Solana underperforming compared to Bitcoin.

The overall CoinDesk 20 Index did not perform as well as Bitcoin, with Ethereum’s ETH and Solana’s SOL lagging behind. Despite this, crypto equities such as Coinbase, MicroStrategy, and miners saw gains of 20%-30%, showcasing the overall positive sentiment in the market.

According to Fundstrat’s head of digital assets strategy, the recent price explosion in the crypto industry can be justified by the shift from an “objectively oppressive regulatory regime to an overtly friendly one overnight.” This change in regulatory outlook has led to increased optimism among investors, driving the prices of cryptocurrencies higher.

Bitcoin’s market capitalization currently stands at around $1.73 trillion, surpassing silver’s market cap. This is not the first time Bitcoin has flipped silver’s valuation, with a similar occurrence happening earlier this year. The positive sentiment around spot exchange-traded funds (ETFs) in March also contributed to Bitcoin’s surge in price.

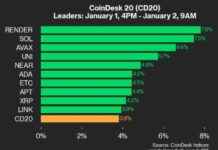

Other cryptocurrencies like Ethereum’s ether (ETH) and Solana (SOL) also saw gains during this period, with ETH surpassing $3,300 and SOL topping $220. Additionally, native tokens of Aptos (APT), Near (NEAR), and Render (RNDR) were among the best-performing constituents of the CoinDesk 20 Index, surging 18%-25%.

Crypto-related stocks experienced significant gains, with Coinbase’s shares closing almost 20% higher and Bitcoin miners like MARA Holdings, CleanSpark, and Hut 8 booking gains of 25%-30%. MicroStrategy, a software company with a significant bitcoin treasury, saw its shares soar 25% to reach a new all-time high price of $340, surpassing its 24-year old record from the dotcom bubble era.

The recent surge in cryptocurrency prices can be attributed to the positive sentiment around digital assets following the U.S. election results. Investors are hopeful for a friendlier approach towards cryptocurrencies under the new administration, especially with Republicans potentially taking control of both houses of the legislation. This optimism has translated into significant gains for Bitcoin and other altcoins in the past week.

Overall, the crypto market continues to show strength and resilience, with Bitcoin leading the way in terms of price performance. The positive regulatory outlook and increased institutional interest in cryptocurrencies have contributed to the recent price surge, highlighting the growing acceptance of digital assets in the financial world.