U.S.-listed bitcoin (BTC) exchange-traded funds (ETFs) experienced a significant outflow of $400.7 million on Thursday, marking the third-largest outflow since their launch, according to Farside data. This outflow comes as bitcoin’s price fluctuated between a low of around $86,600 and highs near $92,000 during yesterday’s trading session. Despite correcting nearly 6% from its all-time high on Nov. 13, when it surpassed $93,000, this price action is not unusual as investors often take profits after new all-time highs.

Over the past three days, investors have withdrawn a total of $15 billion, according to Glassnode data. Since the election of Donald Trump as the new U.S. president earlier this month, bitcoin has surged by over 25%. While BlackRock’s IBIT saw inflows of $126.5 million, indicating a trend of strong inflows since Nov. 7, Fidelity’s FBTC experienced outflows of $179.2 million. Similarly, Bitwise BITB saw $113.9 million being drained, Ark’s ARKB lost $161.7 million, and both Grayscale products saw combined outflows of $74.9 million.

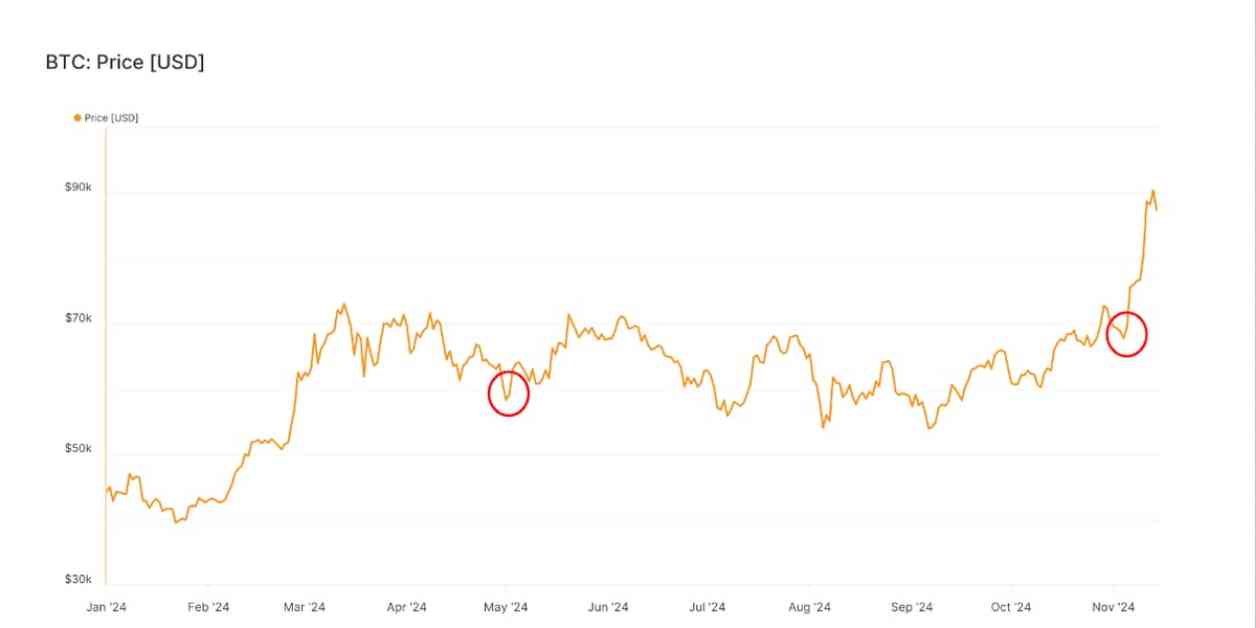

Interestingly, Thursday marked the third worst day for bitcoin-linked ETFs since their launch, with outflows exceeding $400 million. This has occurred only two other times, on Nov. 4 ($541.1 million) just before the U.S. election, and on May 1 ($563.7 million). On both occasions, bitcoin’s price bottomed out, with the November low leading to a surge to over $93,000 and the May low resulting in a bottom just below $60,000. It remains to be seen whether the ETF outflows signal another potential price bottom, as history has shown a pattern of price recoveries following significant outflows.

In contrast, ether (ETH) ETFs experienced their first outflow in nearly two weeks, with investors withdrawing $3.2 million. This shift in investor sentiment towards ether ETFs adds an interesting dynamic to the current market conditions.

As we continue to monitor the ETF flows and their impact on the market, it will be important to observe how these trends play out in the coming days. The cryptocurrency industry is known for its volatility, and these fluctuations in ETF flows can provide valuable insights into investor behavior and market sentiment. Stay tuned for further updates on this evolving situation.

For more updates and analysis on Bitcoin and the cryptocurrency market, follow James, the senior analyst at CoinDesk, on Twitter @btcjvs. James specializes in Bitcoin and the macro environment, leveraging his expertise in on-chain analytics and market trends to provide valuable insights to the crypto community. As always, CoinDesk remains committed to upholding the highest standards of journalistic integrity and editorial independence in its coverage of the cryptocurrency industry.