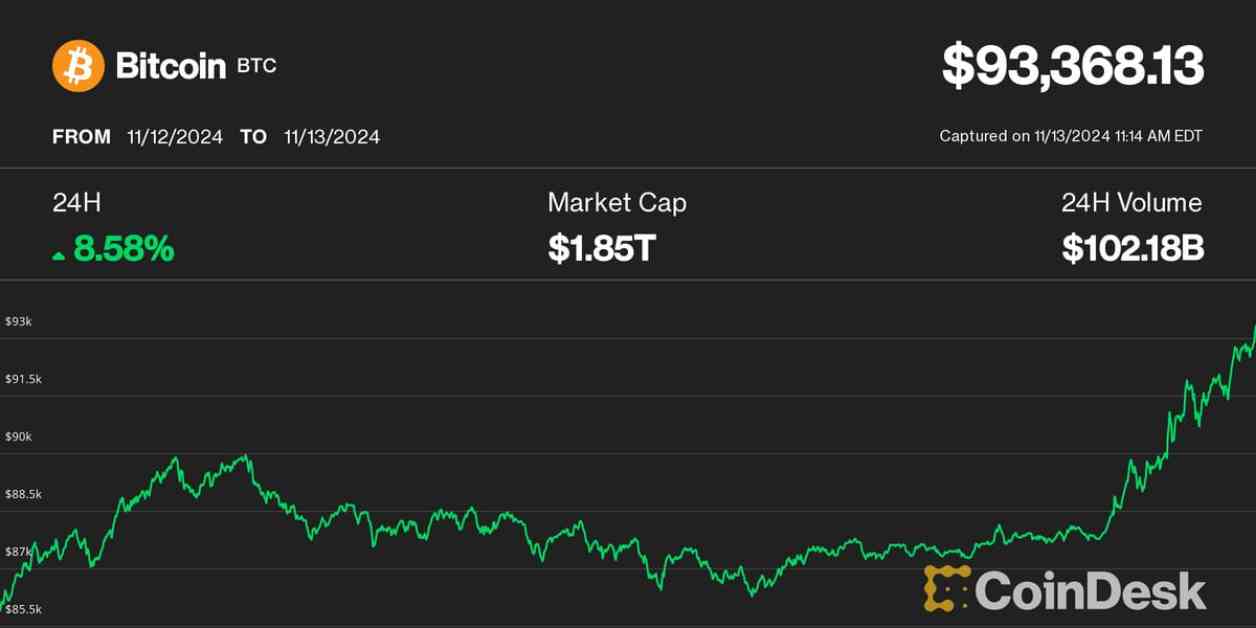

Bitcoin recently made headlines by reaching an all-time high of $93,000, breaking through the $90,000 resistance level during U.S. trading hours. This surge in price was driven by strong demand from U.S. investors, as indicated by the Coinbase Premium Index hitting its highest level since April.

The Blackrock’s iShares Bitcoin ETF (IBIT) also saw significant activity, becoming the fourth-most traded product across all ETFs with a trading volume of $1.2 billion in the first hour of the session. This increased interest in Bitcoin reflects a growing trend towards digital assets in the financial markets.

Despite this impressive milestone, there are questions about whether Bitcoin is losing its bullish momentum. The ETH/BTC ratio has slid to its lowest point since April 2021, leading some investors to wonder if alternative cryptocurrencies like Ethereum are gaining traction.

While Bitcoin has pulled back slightly from its peak, it is still trading at around $92,200, representing a nearly 7% increase over the past 24 hours. This outperformance compared to the broader CoinDesk 20 Index highlights the continued appeal of Bitcoin among investors.

One key factor driving the rally in Bitcoin is spot buying, with strong cumulative volume delta (CVD) showing consistent net buying pressure. This indicates that the current price surge is being supported by actual purchases of Bitcoin, rather than speculative trading in the futures market.

As an award-winning media outlet covering the cryptocurrency industry, CoinDesk is committed to upholding strict editorial policies to ensure integrity, editorial independence, and freedom from bias in its publications. With a team of experienced journalists and analysts like James Van Straten, CoinDesk provides valuable insights into the world of cryptocurrencies.

Stay tuned for more updates on Bitcoin and other digital assets as the market continues to evolve and attract new investors seeking opportunities in the fast-growing cryptocurrency space. Follow @btcjvs on Twitter for the latest news and analysis on Bitcoin and the broader financial markets.