Bitcoin traders are eagerly investing in the $100,000 call option on the Chicago Mercantile Exchange (CME), according to CF Benchmarks. This news comes as the price of Bitcoin surpasses $93,000, reaching new all-time highs. Traders on Deribit are also showing similar bullish behavior.

The demand for the $100,000 call option on the CME, a popular choice among institutional investors, is on the rise. This option gives the buyer the right, but not the obligation, to purchase Bitcoin at a predetermined price on or before a specific date. Traders are showing bullish sentiment by investing in call options, expecting the price of Bitcoin to continue rising.

CF Benchmarks’ data indicates that the 30-day constant maturity 25 delta skew has surpassed the 5 vol threshold, reaching a near year-to-date high. This suggests that there is a greater demand for upside exposure, with call options being more expensive than put options. Traders are preparing for Bitcoin to climb even higher in value.

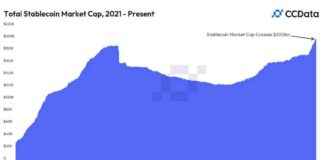

There is also increased interest in strike prices above $100,000, as shown by the elevated implied volatility for these options. The derivatives on CME track CF Benchmarks Bitcoin Reference Rate – New York (BRRNY) variant. The surge in demand for the $100,000 call option on the CME mirrors the trend seen on Deribit since late September.

Despite the continued rise in the dollar index, Bitcoin’s price rally remains strong. Since Donald Trump’s pro-crypto stance and victory in the U.S. presidential election on Nov. 5, Bitcoin prices have surged over 36%.

Overall, the bullish momentum in the Bitcoin market is evident through the increasing demand for call options and the record-breaking price levels. Traders are optimistic about the future price movement of Bitcoin, with expectations of further growth beyond $100,000.

As the cryptocurrency market continues to evolve and attract more institutional investors, the interest in Bitcoin options and derivatives is expected to grow. Investors are closely monitoring market trends and making strategic moves to capitalize on the potential upside of Bitcoin prices. The support from traditional financial institutions like the CME further validates Bitcoin as a valuable asset class with significant growth potential.