MicroStrategy recently made headlines after it was reported that their Bitcoin holdings have reached a staggering $26 billion. This significant increase in value came after the price of Bitcoin surged to $90,000 last week, making MicroStrategy one of the biggest companies holding Bitcoin.

The company’s executive chairman, Michael Saylor, proudly announced that their Bitcoin holdings now exceed the cash reserves of major corporations such as Nike Inc. and IBM Corp. In fact, MicroStrategy’s Bitcoin holdings are on par with the treasury reserves of ExxonMobil and just below those of Intel and General Motors.

MicroStrategy made history in 2020 when it became the first company to invest in Bitcoin. Since then, other companies like MetaPlanet and Tesla have followed suit. Currently, MicroStrategy holds a whopping 279,420 Bitcoins, with their shares skyrocketing by 2,100% since their initial Bitcoin purchase.

Looking ahead, MicroStrategy has ambitious plans to acquire even more Bitcoin. Under their 21/21 Plan, the company aims to invest $42 billion in Bitcoin over the next three years. This plan will involve securing funding through equity and fixed-income securities, with the sole purpose of increasing their Bitcoin holdings.

If successful, MicroStrategy is projected to own 3% of the total Bitcoin supply, equivalent to around 580,000 Bitcoins, by 2026. The company has already made significant investments in Bitcoin, with purchases totaling $458 million in October 2024 and $2 billion in November of the same year.

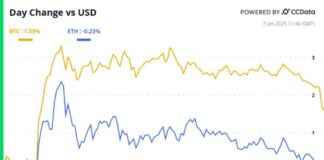

Meanwhile, the overall trading volume of Bitcoin has been on the rise, with a trading volume of around $43 billion in the past 24 hours. This surge in trading activity reflects the growing interest and investment in the world’s largest cryptocurrency by market capitalization.

Overall, MicroStrategy’s bold investment in Bitcoin has paid off handsomely, positioning the company as a major player in the cryptocurrency market. With plans to further increase their holdings in the coming years, MicroStrategy is set to solidify its position as a leader in the digital asset space.