Bitwise, a crypto-investments firm, has made significant strides in offering a Solana exchange traded fund (ETF) in the United States. This move follows the filing of paperwork with the Securities and Exchange Commission (SEC), positioning Bitwise as the fourth company to seek approval for a Solana ETF. Other contenders in the race include Canary Capital, VanEck, and 21Shares.

What sets Bitwise apart is its existing range of ETFs tracking popular cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). These assets are widely considered commodities in the US, making them attractive to Wall Street investors. By expanding its offerings to include a Solana ETF, Bitwise is tapping into the growing interest in this altcoin, which has gained popularity as a trading hub for meme coin enthusiasts.

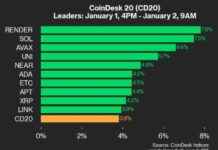

Solana’s native token, SOL, has been performing exceptionally well during the recent bull run, nearing all-time highs last seen in late 2021. This surge in value has piqued the interest of investors looking to capitalize on Solana’s potential growth. Bitwise’s decision to file for a SOL ETF underscores its commitment to providing diverse investment opportunities in the crypto market.

In addition to targeting individual investors, Bitwise also caters to registered investment advisers in the US. With $5 billion in assets under management, the company has established itself as a prominent player in the crypto-investments space. By partnering with Cboe for the proposed Solana ETF, Bitwise aims to leverage the expertise and infrastructure of a leading exchange to bring this product to market.

While Bitwise’s plans for a SOL ETF have generated buzz in the crypto community, the company’s Chief Investments Officer, Matt Hougan, has remained tight-lipped about the specifics. However, the filing of necessary paperwork indicates that Bitwise is moving forward with its proposal, signaling a new chapter in the evolution of crypto-based investment products.

As the regulatory landscape for cryptocurrencies continues to evolve, the potential approval of a Solana ETF could open up new avenues for investors seeking exposure to this innovative blockchain platform. With the backing of established institutions like Bitwise and Cboe, the launch of a SOL ETF could further legitimize Solana as a viable investment option in the digital asset market.

Overall, Bitwise’s entry into the competitive race for Solana ETFs reflects the growing demand for diverse investment products in the crypto space. As the industry continues to mature, investors can expect to see more innovative offerings that cater to a wide range of preferences and risk profiles. With Solana’s star on the rise, the introduction of a dedicated ETF could provide a new avenue for investors to participate in the platform’s success.