Understanding Ethereum’s Surging Price

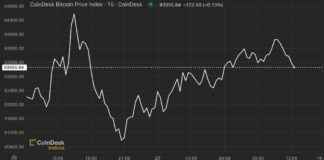

Ethereum enthusiasts, rejoice! The leading altcoin has been making waves in the crypto sphere, with its price surging to $3,840 in the past 24 hours. This positive momentum comes after months of bearish consolidations, signaling a potential bull run for Ethereum.

At the time of writing, Ethereum is up 4%, tantalizingly close to its six-month high of $3,900. This recent uptick in price can be attributed to Bitcoin’s rally above the $100,000 threshold, providing a positive push for the entire crypto market.

What’s Fueling Ethereum’s Rally?

Several factors are at play driving Ethereum’s upward trajectory, creating a frenzy of buying pressure among investors. One key driver of this surge is the significant inflow of funds into U.S.-based spot Ethereum exchange-traded funds. Data from Farside Investors reveals that these ETFs recorded a net inflow of $882.3 million since November 22, primarily from BlackRock’s ETHA fund.

Additionally, Ethereum saw a substantial exchange net outflow of $820 million in the last seven days, indicating a strong accumulation of the asset by investors. This trend is further supported by data showing that 74% of Ethereum holders have held onto their assets for over a year, potentially reducing selling pressure on the altcoin.

Whale Activity and DeFi Growth

Whale transactions involving at least $100,000 worth of ETH have surged to $73 billion in the past week. This spike in whale activity often triggers FOMO among retail investors, leading to increased buying pressure as market conditions turn greedy.

Moreover, Ethereum’s decentralized finance (DeFi) sector has been flourishing, with the total value locked (TVL) hitting a 31-month high of $134.7 billion. This robust growth in DeFi further bolsters Ethereum’s price surge and overall market sentiment.

What’s Next for Ethereum?

As Ethereum continues on its bullish trajectory, traders and investors are closely monitoring its Relative Strength Index (RSI), currently at 63. Despite the price hike to June highs, Ethereum’s RSI suggests a maturing accumulation phase for the altcoin, akin to the digital gold narrative.

While the excitement around Ethereum’s price surge is palpable, it’s essential to approach crypto investments with caution and conduct thorough research before diving in. Remember, the crypto market is volatile and unpredictable, so always proceed with care and diligence in your investment decisions.