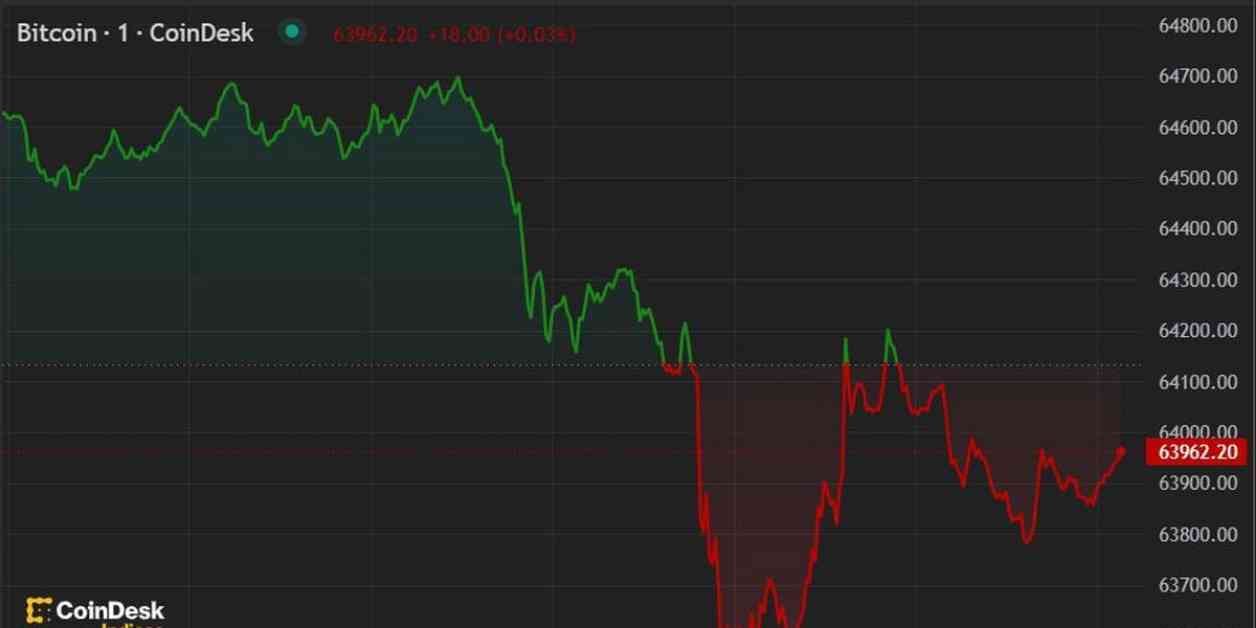

Bitcoin’s price dropped below $64,000 for the first time in over a month, hitting $63,500 during the European morning. This represents a 3.5% decrease in the last 24 hours, with the current price hovering around $63,900. The broader digital asset market, as measured by the CoinDesk 20 Index (CD20), has also seen a decline of just under 2.3%. Other cryptocurrencies like ETH and SOL have also experienced drops, with ETH down 2.25% at $3,500 and SOL falling almost 3.8% to $132.24.

In the U.S., spot bitcoin ETFs have recorded five consecutive days of outflows, totaling $900 million for the week. This outflow activity is the highest since late April, with data from SoSoValue showing that 11 listed ETFs lost $140 million on Thursday alone, with $1.1 billion in trading volumes. Grayscale’s GBTC and Fidelity’s FBTC were among the ETFs with the highest outflows, while BlackRock’s IBIT was the only product with net inflows, adding $1 million.

On another note, Standard Chartered is reportedly setting up a spot trading desk for bitcoin and ether, joining the ranks of global banks entering the cryptocurrency trading space. The London-based desk, part of the bank’s FX trading unit, is expected to commence operations soon. This move signifies Standard Chartered’s increasing involvement in the cryptocurrency sector, having previously backed digital asset custodian Zodia Custody and its exchange arm Zodia Markets.

According to a chart from Fidelity, the U.S. and other major economies are still in a late expansion stage of the business cycle, indicating potential for further growth in bitcoin before a recession hits. This insight has led some analysts to predict a possible uptrend in bitcoin prices before a market downturn prompts risk aversion.

In conclusion, despite the recent price drop in bitcoin and other cryptocurrencies, market dynamics continue to evolve with the introduction of new trading desks and changing investor sentiment. As the cryptocurrency industry remains volatile, it is important for investors to stay informed and assess the market conditions before making any investment decisions.