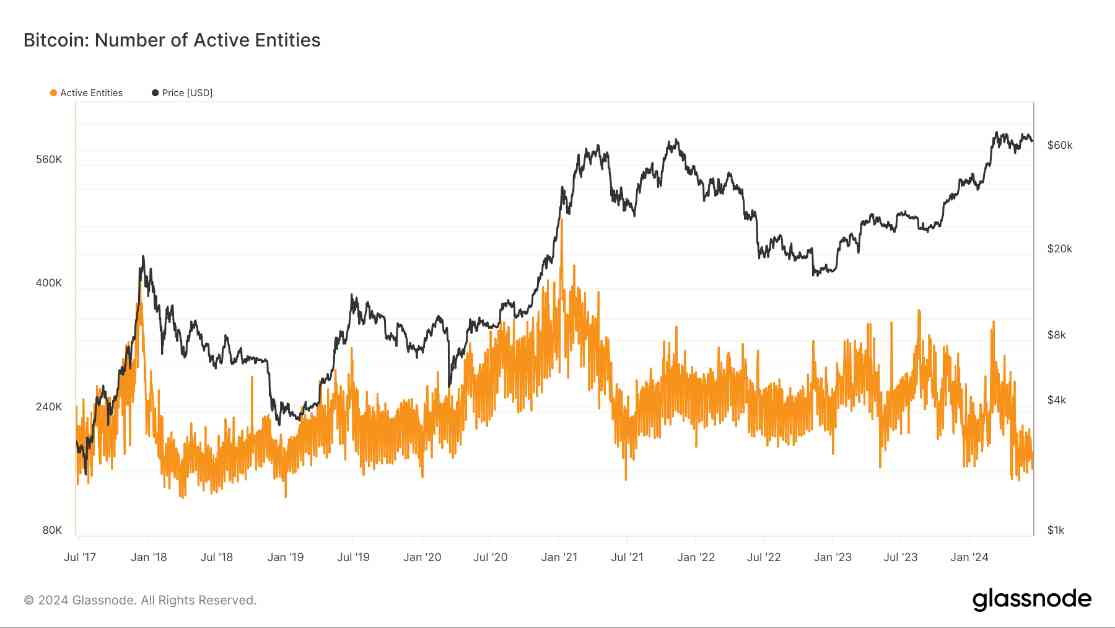

Bitcoin active entities have taken a significant hit post-halving, reaching the lowest levels seen in three years. This decline can be attributed to a surge in transaction fees and network congestion, making it less appealing for daily transactions. The number of unique entities active on the Bitcoin network has historically provided valuable insights into market phases, with a decrease in active addresses often indicating reduced user engagement during bear markets.

Despite the decrease in active entities, Bitcoin’s price has been approaching all-time highs, showcasing the market’s resilience in the face of these challenges. The recent halving event has played a crucial role in shaping these trends, with transaction fees spiking to levels not seen since December 2017 on the day of the halving. These fees accounted for over 75% of miner revenue, significantly impacting network activity.

The relationship between transaction costs, network usage, and Bitcoin’s market behavior is complex and multifaceted. While the decrease in active entities may raise concerns about user engagement, the resilience of Bitcoin’s price suggests that investors and traders remain optimistic about the cryptocurrency’s long-term potential.

Moving forward, it will be interesting to see how the Bitcoin network adapts to these challenges and whether new solutions or protocols will emerge to address issues such as high transaction fees and network congestion. Despite the current low in active entities, the underlying strength of the Bitcoin market indicates that there is still significant interest and confidence in the cryptocurrency among investors and traders.

As the cryptocurrency landscape continues to evolve, monitoring metrics such as active entities can provide valuable insights into market dynamics and investor sentiment. While the recent decline in active addresses may raise some concerns, it is essential to consider the broader context of market trends and developments when evaluating the health and resilience of the Bitcoin network.