Bitcoin ETFs and Ethereum ETFs are paving the way for significant changes in the cryptocurrency market, with recent data showing a substantial impact on supply dynamics. Let’s delve into the details of the latest trends and developments in the world of crypto ETFs.

Bitcoin ETFs Drive Supply Scarcity

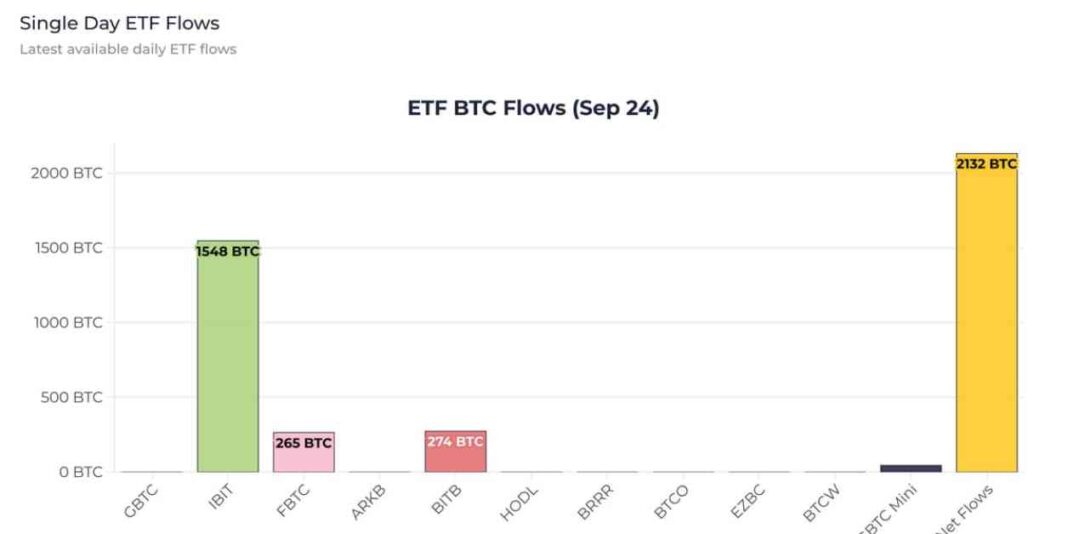

Bitcoin ETFs have been instrumental in reducing the daily supply of BTC by a significant margin. Inflows into bitcoin ETFs reached $136 million on September 24, with BlackRock’s IBIT ETF leading the charge with $98.9 million in inflows. This amount is equivalent to 1,548 BTC, marking a substantial contribution to the overall supply scarcity in the market.

The data from Farside Investors highlights the growing interest in bitcoin ETFs, with total net inflows surpassing $21 billion. This influx of capital is a clear indicator of investors’ confidence in these investment vehicles and their potential to generate returns in the volatile crypto market.

The impact of these inflows is particularly noteworthy when considering the daily issuance of Bitcoin, which currently stands at around 450 BTC. The inflows on September 24 alone represented nearly five times the daily mined supply, underscoring the significant role that ETFs are playing in shaping the supply dynamics of Bitcoin.

Ethereum ETFs See Strong Recovery

On the Ethereum front, Ether ETFs experienced a strong recovery on September 24, with total inflows amounting to $62.5 million. BlackRock’s ETHA ETF led the way with $59.3 million in inflows, marking its largest influx since August 9. This rebound came on the heels of a day of significant outflows, highlighting the inherent volatility in the crypto markets.

Despite the recovery, total outflows from ether ETFs still stand at $624.4 million, reflecting the uncertainty investors face in comparison to Bitcoin. The resurgence in inflows on September 24 signals renewed interest in Ethereum and its potential for growth in the digital asset space.

Market Outlook and Price Trends

As of press time, Bitcoin is trading at $63,803, while Ethereum is trading at $2,624, according to CoinDesk data. These price levels reflect the ongoing market dynamics and investor sentiment towards the two leading cryptocurrencies.

Overall, the influx of capital into Bitcoin and Ethereum ETFs is a positive sign for the crypto market, indicating growing interest from institutional and retail investors alike. The impact of these inflows on supply scarcity and price movements will continue to be closely monitored as the market evolves.

In conclusion, Bitcoin ETFs are playing a crucial role in reducing the daily supply of BTC, while Ethereum ETFs are experiencing a strong recovery in inflows. These developments underscore the growing significance of ETFs in shaping the dynamics of the cryptocurrency market and influencing investor behavior. As the market continues to evolve, it will be interesting to see how these trends impact the overall landscape of digital assets.