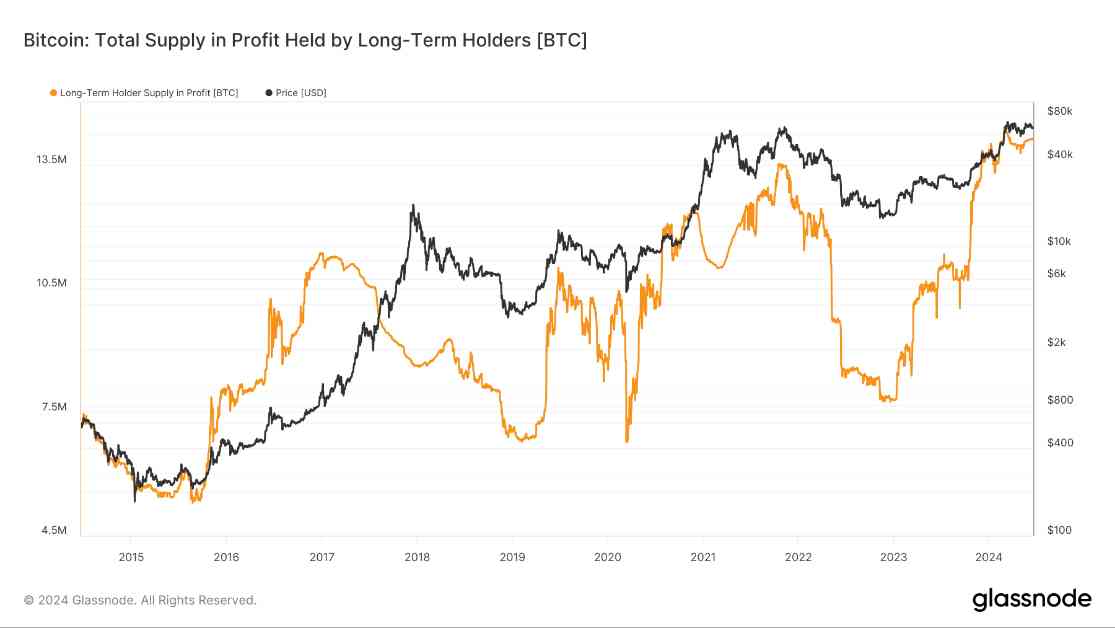

Bitcoin long-term holders continue to show confidence in the market, with over 14 million BTC currently held in profit. This resilience is a positive sign of market stability, as long-term holders remain steadfast in their positions despite short-term price fluctuations.

The data from Glassnode indicates a consistent increase in the total supply of profit held by long-term holders, reflecting strong market sentiment. Although there was a slight dip below 14 million BTC earlier this year, the numbers have since recovered and are on a steady rise. This demonstrates that long-term holders are not swayed by short-term market movements and are using their holdings as a hedge against volatility.

It is interesting to note the contrasting behavior of short-term holders, who tend to take profits during market surges by transferring funds to exchanges. This activity contributes to increased market liquidity and short-term price adjustments. On the other hand, long-term holders continue to accumulate Bitcoin, showcasing their enduring confidence in the value of the cryptocurrency.

In conclusion, the dichotomy between the stability of long-term holders and the volatility of short-term holders continues to shape the forces in the Bitcoin market. While short-term holders may seek immediate profits, long-term holders are focused on the long-term potential of Bitcoin as a valuable asset. This trend highlights the different strategies employed by investors in navigating the ever-changing cryptocurrency market landscape.