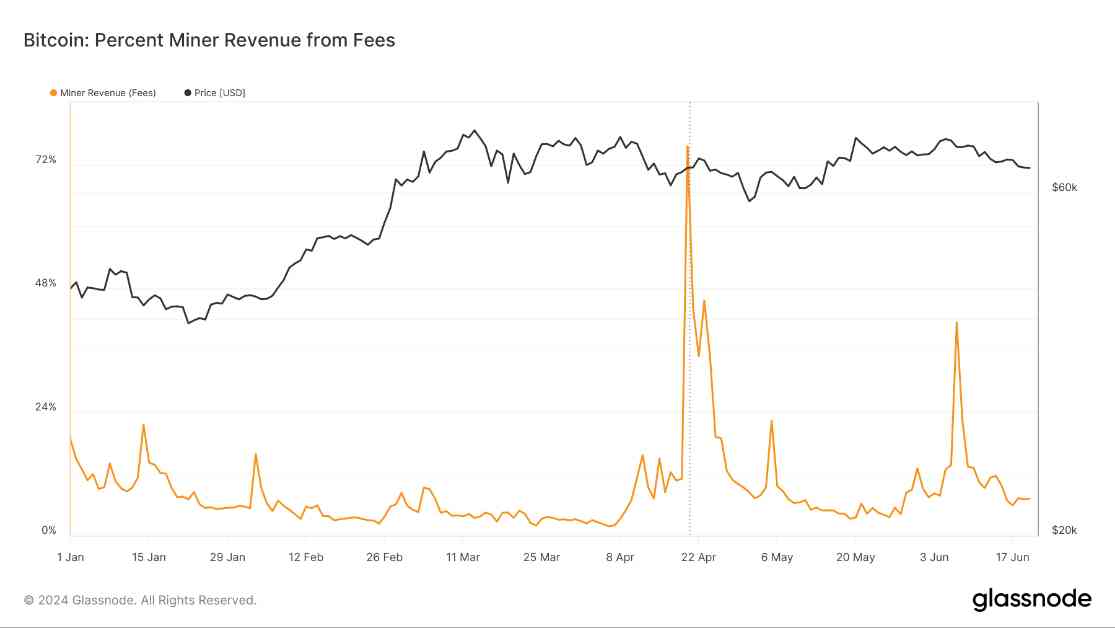

Bitcoin miners are currently experiencing a significant shift in their revenue sources, with transaction fees playing a more dominant role. According to recent data from Glassnode, there has been a noticeable fluctuation in the percentage of miner revenue derived from transaction fees throughout the year. In early 2024, miner revenue from fees saw a sharp increase in April, reaching nearly 72%, before stabilizing at lower percentages in the following months. This surge in fee revenue coincided with the launch of Runes during the halving event, leading to a spike in fees due to increased demand for transaction processing.

Historically, peaks in fee revenue have been associated with major price movements or network congestion periods. Looking back to 2014, the chart shows periodic spikes in fee revenue during significant bull runs and times of network congestion. The recent trend indicates that miners stand to benefit greatly from transaction fees when Bitcoin prices and network activity are on the rise, highlighting the importance of transaction fees in miners’ revenue streams. Although the hype around Inscriptions and Runes has subsided for now, a potential resurgence could be highly profitable for miners.

Glassnode emphasizes the importance of understanding these trends in predicting miners’ financial well-being and the broader economic forces at play in the network. By keeping an eye on the percentage of miner revenue derived from fees, stakeholders can gain valuable insights into the health of the mining industry and the overall economic dynamics of the Bitcoin network.

In conclusion, the recent shift in Bitcoin miner revenue towards transaction fees underscores the evolving nature of the mining industry. As transaction fees become an increasingly significant source of revenue for miners, it is essential for stakeholders to monitor these trends closely and adapt to changing market conditions. By staying informed and proactive, miners can position themselves for success in a rapidly changing landscape.