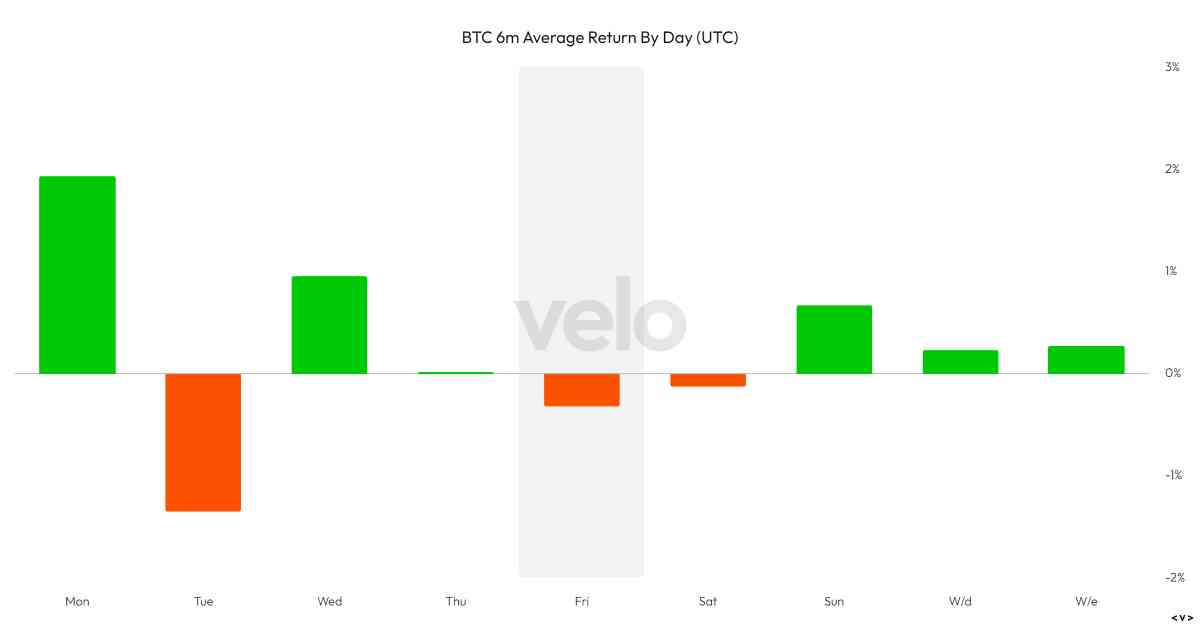

Bitcoin faced another slight dip on Friday, dropping over 1% and continuing a trend that has been observed over the past six months. According to data from Velo, Fridays have historically been the second worst-performing day for the coin, with an average decline of -0.5%. This recent drop aligns with that trend, indicating a consistent pattern.

Looking back over a one-year timeframe, Fridays still show a slightly negative performance, with an average decline of -0.4%. However, Tuesdays stand out as the most challenging day for Bitcoin investors, with an average decline of -2% within the same period. This information provides valuable insights for those looking to optimize their investment strategies based on historical trends.

In order to signal a potential recovery and gain positive momentum among short-term investors, Bitcoin will need to reclaim the $64,097 mark. This level is crucial for surpassing the short-term holder’s realized price and could pave the way for a more optimistic outlook in the near future.

Despite the recent dip, it’s important for investors to consider the broader context and historical data when making decisions about their Bitcoin holdings. Understanding patterns and trends can help inform strategies and mitigate risks in an ever-changing market.

As the cryptocurrency landscape continues to evolve, staying informed and adaptable is key to navigating the fluctuations and maximizing potential gains. By keeping a close eye on market trends and utilizing available data, investors can position themselves for success in the dynamic world of Bitcoin trading.