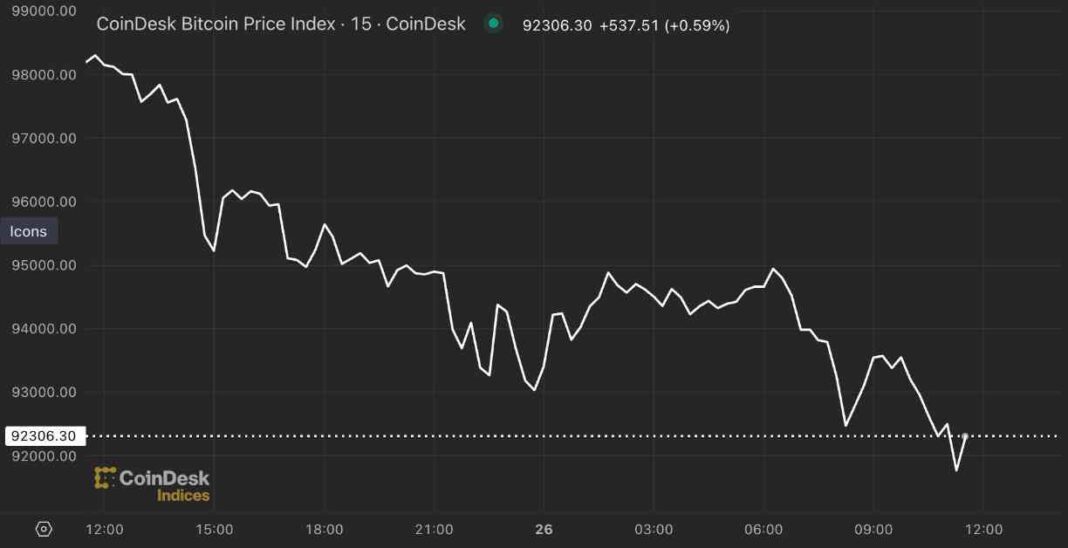

Bitcoin’s price has taken a hit, dropping below $93,000 as the market correction continues for the third day. The asset has seen a 6% decrease in the past 24 hours, causing BTC to lose its weekly gains and fall to less than 1%. This dip has led to profit-taking and a pullback in the market. Other major tokens like Solana’s SOL, BNB, Cardano’s ADA, and DOGE have also experienced a drop of as much as 7% in the last day.

The CoinDesk 20 Index, which tracks the biggest tokens by market capitalization, excluding stablecoins, has seen a nearly 3% decline. Analysts suggest that a correction of up to 10% from the peak is normal, with a short-term target of $100,000 per BTC still in sight. Some indicators point to a further correction in BTC’s price, potentially going as low as $90,000. The 25-delta risk reversal, a measure of volatility premium, has shown a negative reading for the first time in at least a month, indicating a preference for protective puts.

While bitcoin is facing a correction, ether is showing signs of strength. ETH climbed to over $3,500 for the first time since June, outperforming the broader market. Despite trading 5% lower in the last 24 hours, ether has been relatively resilient compared to the rest of the market, which has seen an 8% decrease. Investors have been shifting their focus to smaller and riskier cryptocurrencies following the slowdown in bitcoin’s price surge.

In other news, the Defiance Daily Target 2x Long MSTR ETF, which seeks to deliver twice the daily performance of MicroStrategy’s shares, has experienced a significant drop of 41% in just three days. This ETF is tied to the performance of MicroStrategy, which has also seen a 20% decrease in its shares. The market continues to be volatile, with both profits and losses being magnified by leverage.

As the market correction unfolds, it will be interesting to see how bitcoin and other cryptocurrencies respond in the coming days. Investors and traders are advised to proceed with caution and stay informed about the latest developments in the crypto space.