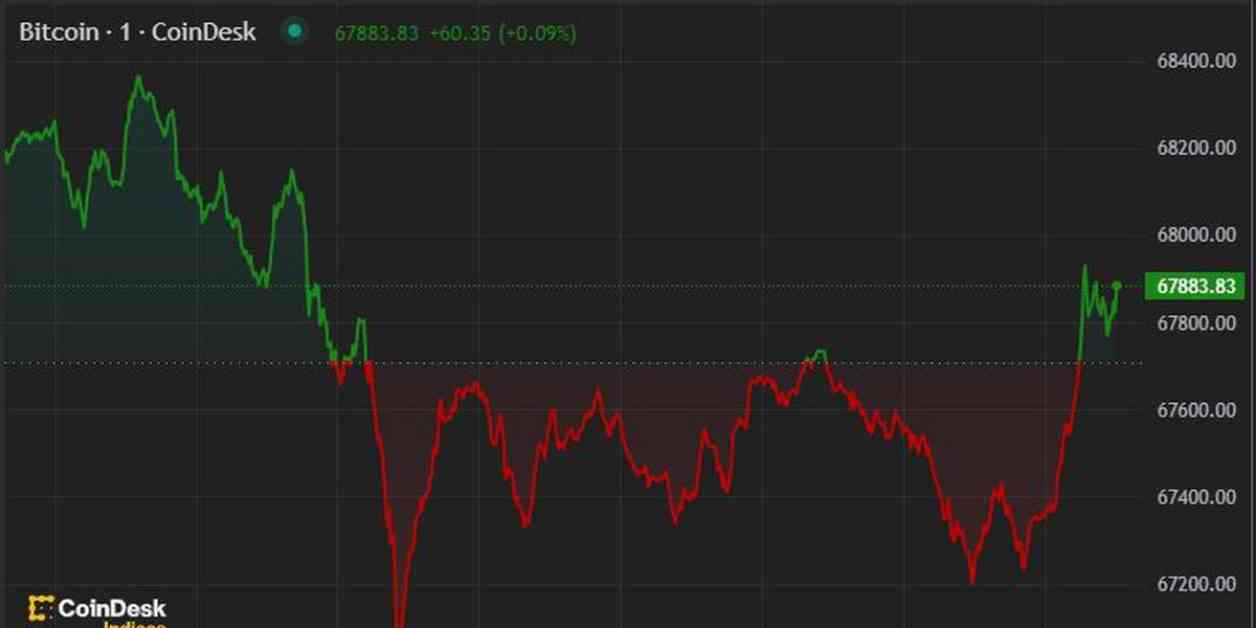

Bitcoin price remains steady above $67,000 after the Federal Reserve’s announcement of a single interest rate reduction this year. The cryptocurrency dipped slightly to around $67,000 during Asian trading hours but quickly rebounded to trade between $67,200-$67,800. Currently, bitcoin is sitting above $67,900, showing a slight increase of 0.16% in the last 24 hours. On the other hand, the CoinDesk CD 20 is down 0.34% during the same period. Ether, on the other hand, has been fluctuating around $3,500 and is currently down by 1.1% in the last 24 hours.

Paxos, a digital asset platform, has announced layoffs amounting to 20% of its staff, which equates to 65 employees. CEO Charles Cascarilla stated that these layoffs will help the company focus on opportunities in tokenization and stablecoins. Paxos plans to discontinue settlement services in commodities and securities to concentrate more on asset tokenization and stablecoins. Despite the layoffs, the company remains financially strong with a balance sheet of around $500 million.

In contrast, Curve’s CRV token experienced a significant drop of 30% in early Asian trading hours due to the automatic liquidation of loan positions allegedly tied to its founder, Michael Egorov. Egorov’s addresses have reportedly taken out loans worth nearly $100 million in stablecoins using CRV tokens as collateral. This sudden selling activity has led to a decrease in total holdings across tracked wallets by 50% in the past 24 hours. Additionally, data shows that the number of CRV held in wallets linked to centralized exchanges spiked by 57% to record highs above 480 million, indicating investor intention to sell the CRV token.

It is important to note that CoinDesk, the media outlet reporting on these developments, was acquired by the Bullish group in November 2023. The Bullish group, majority-owned by Block.one, operates a regulated digital assets exchange and has significant holdings in blockchain and digital asset businesses, including bitcoin. Despite the acquisition, CoinDesk functions as an independent subsidiary with an editorial committee to maintain journalistic independence. Some CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Overall, the cryptocurrency market continues to see fluctuations in prices and investor behavior, influenced by factors such as interest rate projections, liquidation activities, and market trends. Investors should stay informed and exercise caution when navigating the volatile crypto landscape.