Bitcoin’s Next Rally Hinges on Miner Capitulation: Survival of the Fittest

Renowned crypto analyst Willy Woo has shed light on the complex road ahead for Bitcoin amidst declining prices and economic uncertainty. According to Woo, the key to understanding when Bitcoin might start its recovery lies in observing miner capitulation and the subsequent recovery of the hash rate.

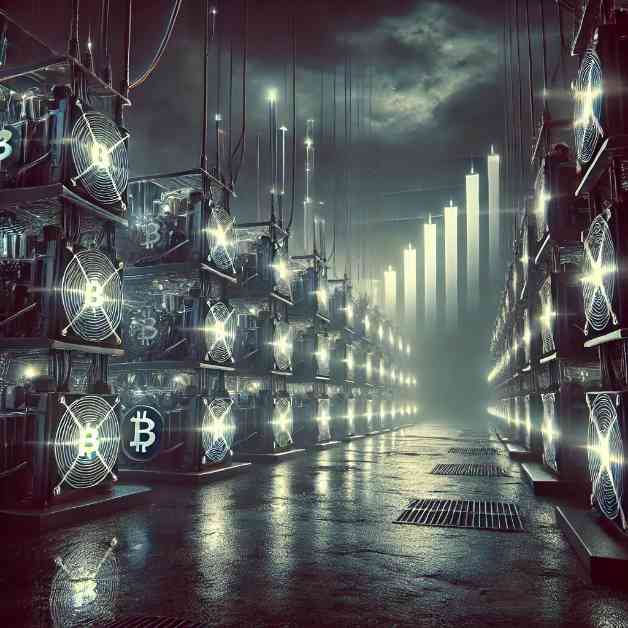

Miner capitulation is a critical phase where less efficient miners are forced to sell their holdings and exit the market, decreasing selling pressure and paving the way for potential price increases. However, the current cycle appears prolonged, with miners taking longer than usual to capitulate due to new market mechanisms like ordinal inscriptions.

Woo emphasizes the importance of monitoring Bitcoin’s hash ribbons, which provide insights into the economic viability of Bitcoin mining. A reduction in hash ribbons suggests that the worst of the sell-off may be over, signaling a potential recovery. In addition to hash ribbons, investors should keep an eye on broader market signals to navigate the current speculative environment.

While the extended adjustment period might be challenging for investors, it is a necessary step towards achieving a healthier market. Woo notes that Bitcoin is unlikely to break all-time highs until more pain and boredom play out, but when miner capitulation is complete, it often ends in a significant rally. Therefore, investors should look for compressions in the hash ribbon and consider buying and holding in these regions.

In summary, the road to Bitcoin’s next rally hinges on miner capitulation and the recovery of the hash rate. While the current cycle may be prolonged, it is a crucial phase for setting a solid foundation for future growth. By monitoring key indicators like hash ribbons and broader market signals, investors can navigate the current market environment and position themselves for potential gains in the future.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Investors are advised to conduct their own research before making any investment decisions and to be aware of the risks involved in investing in cryptocurrencies.