Crypto Daybook Americas: Analysis of Bull Momentum and Fed Rate Cut

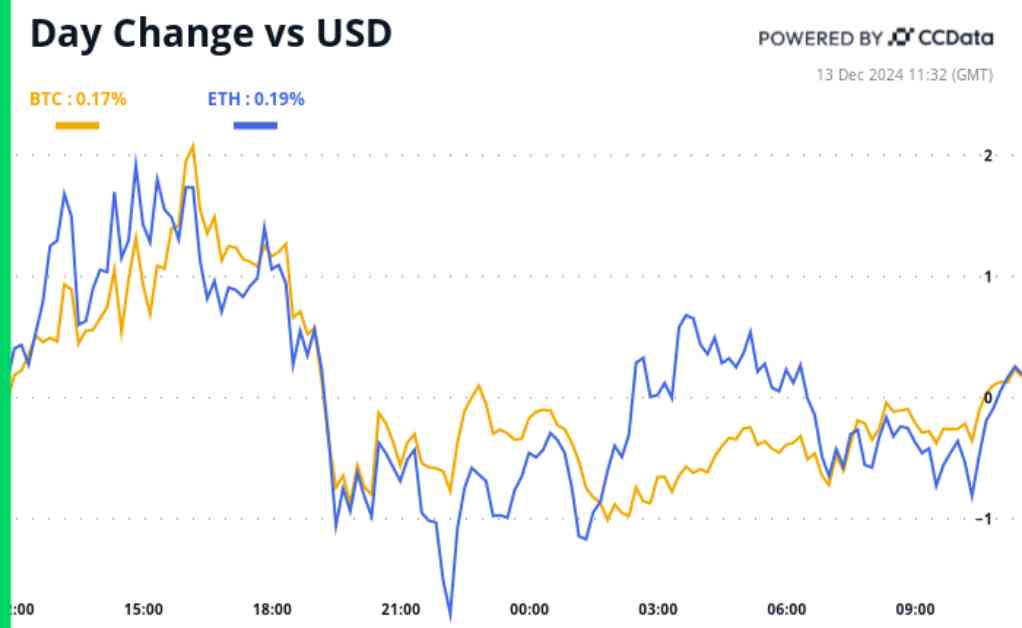

Bitcoin and ether, the two leading cryptocurrencies, are facing a roadblock in their bull momentum. This shift comes after the U.S. Producer Price Index (PPI) reported a higher-than-expected figure on Thursday. Investors are now tightening their stances and favoring the dollar in response to this news. Additionally, concerns are rising due to the Truflation index, which some consider more reliable than government data. The index has surpassed 3% for the first time in over two years, adding to the cautious sentiment in the market.

Market Sentiment and Activity

Despite these challenges, traders on decentralized exchanges remain bullish, with confidence in a 25 basis points rate cut by the Federal Reserve next week. This positive sentiment is reflected in the substantial open interest for active BTC call options on Derive, indicating a strong belief in the market’s upward potential. Ether traders are also leaning towards calls, as shown by data from Amberdata. Moreover, funding rates for BTC, ETH, and SOL on HyperLiquid are positive, suggesting a bullish sentiment tempered by measured leverage levels.

In the broader market, AVAX, the native token of the Avalanche network, is struggling to break through selling pressure near $55, hinting at a possible “double top” pattern forming on the charts. This lackluster price action follows a recent $250 million fundraise led by prominent investment firms. Keep an eye out for increased volatility as the Avalanche9000 upgrade is scheduled to go live on December 16, aiming to enhance the platform’s capabilities for creating layer-1 chains.

Token Events and Market Flows

In the token space, governance votes and calls are actively shaping the future of various projects. For example, the Arbitrum DAO is voting on allocating funds to cover operating costs, while the Polygon community is considering deploying a significant portion of its stablecoin reserve to generate yields. Additionally, upcoming token unlocks and launches, like those of Axie Infinity and Starknet, offer insights into market dynamics and investor sentiment.

Overall, the crypto market is facing a mix of challenges and opportunities, with varying sentiments across different tokens and projects. As the landscape evolves, investors and traders must stay informed and vigilant to navigate these rapid changes effectively. Stay tuned for more updates on the crypto market and how it continues to shape the financial world.