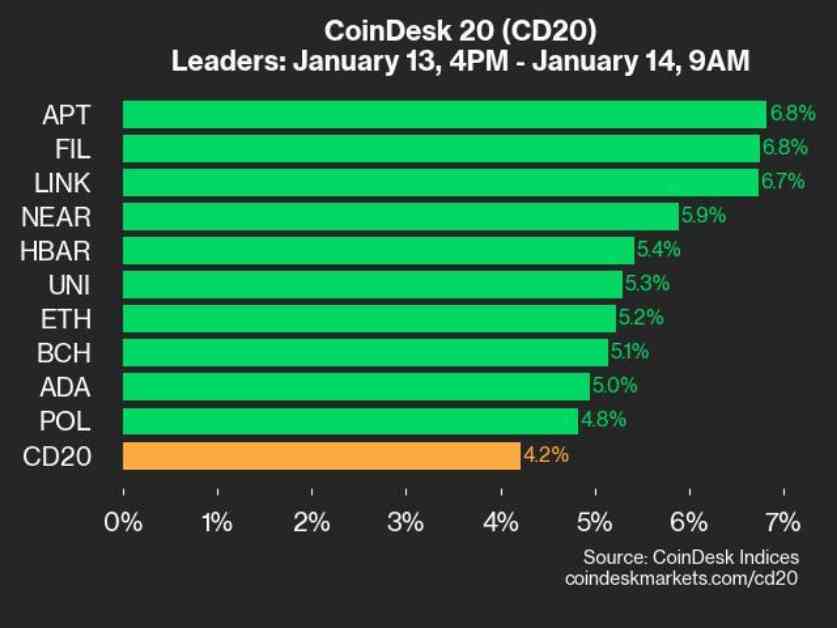

Crypto Market Update: APT and FIL Lead with 6.8% Gain

In the latest Crypto Market Update, Aptos (APT) and Filecoin (FIL) emerged as top performers, both seeing a 6.8% gain from Monday’s trading session. Chainlink (LINK) also joined the ranks of the leading assets with a 6.7% increase. The market update, provided by CoinDesk Indices, showcases the ongoing fluctuations in the digital asset space.

All Assets Trade Higher; CoinDesk 20 Index Surges

As of January 14, 2025, at 2:15 p.m. UTC, the CoinDesk 20 Index is currently trading at 3447.59, marking a significant 4.2% increase (+139.62) since 4 p.m. ET on Monday. Notably, all 20 assets included in the index are trading higher, indicating a positive trend across the board.

Expert Insights from Tracy Stephens, Senior Index Manager

Tracy Stephens, Senior Index Manager at CoinDesk Indices, sheds light on the market dynamics and the factors influencing the recent surge in asset prices. With a background in traditional finance and a focus on maintaining robust trading standards, Tracy brings a unique perspective to the crypto space. Her experience in building systematic trading strategies at renowned asset management firms adds depth to her analysis of the current market trends.

Global Impact of CoinDesk 20 Index

The CoinDesk 20 Index serves as a comprehensive benchmark for tracking the performance of digital assets across various platforms and regions worldwide. Its broad-based approach provides valuable insights into the overall health of the crypto market and helps investors make informed decisions based on the latest data.

As the crypto market continues to evolve and attract a diverse range of participants, staying informed about key developments and trends becomes essential for navigating this dynamic landscape. With leading assets like APT and FIL showcasing notable gains, investors are closely monitoring the market for potential opportunities and risks.

Tracy Stephens’ expertise and the insights from the CoinDesk 20 Index offer a holistic view of the crypto market, highlighting both the successes and challenges faced by digital assets. By staying informed and leveraging expert analysis, investors can better position themselves to capitalize on the ever-changing dynamics of the crypto space.