Unveiling the Future: On-Chain Insights for 2025

In the ever-evolving landscape of Web3, the ability to decipher on-chain data is becoming increasingly crucial for sustainable growth and success. Amidst the chaos of transaction volumes, token prices, and headlines, the real key lies in understanding the quality of user engagement and the potential for organic growth. As we approach 2025, let’s dive into the on-chain metrics that are shaping the future of leading chains like SOL, ETH, and others.

Decoding User Quality Through Data

When it comes to building a robust on-chain ecosystem, analyzing isolated user actions isn’t enough. What’s essential is aggregating user behaviors across various categories to gain a comprehensive understanding of user engagement. By incorporating metrics such as transaction activity, token accumulation, DeFi engagement, NFT activity, and governance participation into a unified scoring system, we can unveil the depth and quality of user interactions on different chains. This approach allows us to move beyond traditional scoring systems and generate dynamic, multi-variate scores that offer more accurate insights into user activity.

Insights from 2024 and Beyond

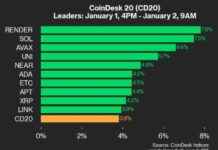

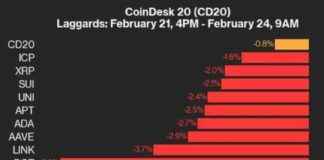

Examining the on-chain activity of leading chains in 2024 reveals intriguing trends and signals for the future. For instance, while Solana experienced a surge in high-quality users earlier in the year, its engagement quality has since declined. On the other hand, Ethereum’s user score remained stable throughout 2024, indicating a different trajectory for the chain. Additionally, the data highlights Axelar as a platform with active users engaged in diverse on-chain activities, signaling growth potential despite its smaller size compared to legacy chains.

Predictions for 2025 and Beyond

Looking ahead to 2025, each chain’s user quality track record provides valuable insights into what to expect in the coming year. Solana faces challenges in retaining its user base and expanding interactions to avoid a potential slump, while Axelar aims to scale its ecosystem without compromising user quality. Ethereum’s shift towards its L2 ecosystem may impact mainnet activity, emphasizing the importance of defining success metrics tailored to specific chains.

In conclusion, the future of Web3 lies in prioritizing user quality over hype-driven narratives. By leveraging innovative scoring methods and data-driven strategies, the industry can unlock the full potential of blockchain technology in 2025 and beyond. As we navigate this evolving landscape, understanding the intricacies of on-chain data will be key to shaping the success of tomorrow’s leading chains.

Dr. Angela Minster and Eric Stone, experts in data science and blockchain growth, provide valuable insights into the transformative power of on-chain metrics and their role in shaping the future of Web3. Through their expertise and experience, they offer a glimpse into the possibilities that lie ahead for blockchain technology and the importance of data-driven strategies in driving sustainable growth in the industry.