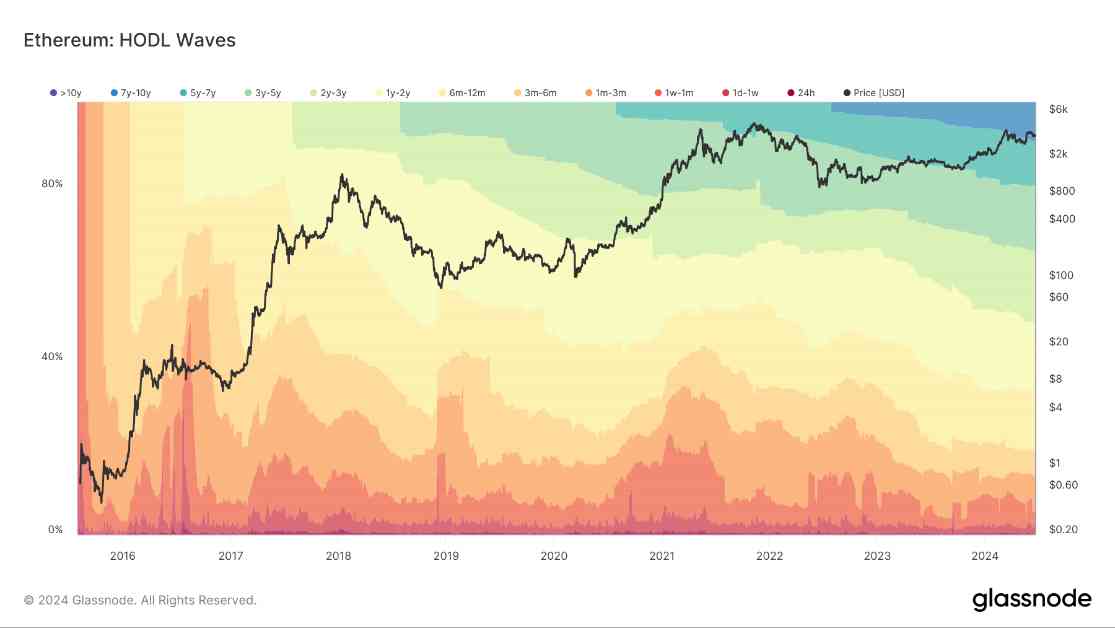

Long-term Ethereum investors have reached a new high, according to the latest data on Ethereum’s HODL Waves chart. This chart shows the distribution of Ethereum held over various time periods, indicating changes in investor behavior.

One of the key trends highlighted by the chart is the concentration of Ethereum held for one to three years. This suggests that a significant amount of Ethereum acquired during the 2021-2022 period is still being held by investors. This indicates a high level of confidence in Ethereum’s long-term value, as many investors are choosing to hold onto their assets rather than selling in response to market fluctuations.

Additionally, there has been a decline in the proportion of Ethereum held for less than six months, further supporting the trend of long-term holding strategies among investors. On the other hand, the proportion of Ethereum held for more than seven years has increased, indicating the presence of long-term holders who have experienced multiple market cycles.

This stability among long-term holders reflects a strong belief in Ethereum’s foundational value and its potential for future growth. Overall, the HODL Waves chart provides valuable insights into Ethereum’s market trends, showing that investors are increasingly committed to long-term holding strategies in the face of changing market conditions.

In conclusion, the data on Ethereum’s HODL Waves chart paints a picture of a growing number of long-term investors who are confident in Ethereum’s future prospects. This suggests that Ethereum continues to attract investors who believe in its long-term value and are willing to hold onto their assets despite market fluctuations.