MicroStrategy Continues Bitcoin Buying Streak: Acquires 2,138 BTC

MicroStrategy, the leading bitcoin development company, has made headlines once again by adding to its already substantial bitcoin holdings. In a move that showcases its unwavering confidence in the cryptocurrency, the company acquired an additional 2,138 BTC, bringing its total holdings to an impressive 446,400 BTC.

A Closer Look at the Purchase

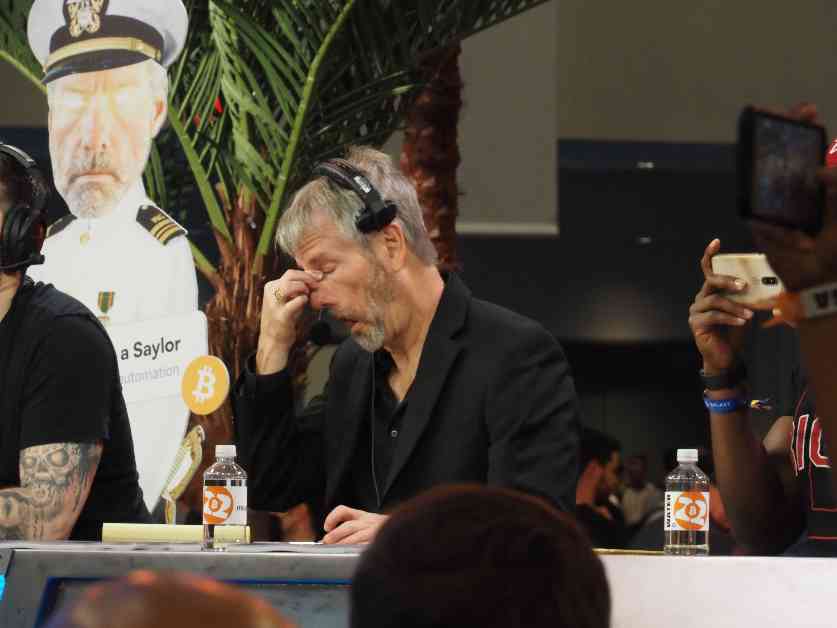

The purchase, which amounted to $209 million, marks the eighth consecutive week that MicroStrategy has increased its bitcoin stash. Executive Chairman Michael Saylor hinted at the acquisition in a post on X, further solidifying the company’s commitment to investing in the digital asset.

The average purchase price of bitcoin stood at $97,837, contributing to an average purchase price of $62,428 for MicroStrategy. The funds for this latest acquisition were generated through share sales under the company’s at-the-market (ATM) program, with $6.88 billion still available in the program.

Expert Analysis and Market Impact

James Van Straten, a senior analyst at CoinDesk with a deep understanding of Bitcoin and the macro environment, provided valuable insights into this development. With a background in on-chain analytics and a diverse investment portfolio that includes bitcoin and MicroStrategy shares, Van Straten’s perspective sheds light on the significance of MicroStrategy’s continued bitcoin purchases.

MicroStrategy’s recent inclusion in the Nasdaq 100 index, ranking 57th with an index weighting of 0.38%, underscores its growing influence in the financial market. Despite a share price currently sitting 40% below its record high, the company’s strategic investment approach continues to attract attention from investors and industry experts alike.

In conclusion, MicroStrategy’s ongoing accumulation of bitcoin highlights its confidence in the long-term potential of the cryptocurrency. As the company solidifies its position as a major player in the digital asset space, all eyes are on its future moves and their impact on the broader market.