MicroStrategy, a software firm known for diversifying its corporate treasury into cryptocurrency, is making waves in the bitcoin capital markets, according to a recent report by broker Bernstein. The company has taken a pioneering approach to investing in bitcoin, raising a substantial $4 billion of convertible debt specifically for the purpose of purchasing more of the popular cryptocurrency.

Unlike other corporations, MicroStrategy has successfully developed institutional demand for bitcoin-linked convertibles, setting it apart in the market. With a current holding of 214,400 bitcoins valued at approximately $14.5 billion, the firm has been steadily accumulating the digital asset since 2020. This strategic approach has allowed MicroStrategy to grow its bitcoin per equity share by nearly 67% over the past four years.

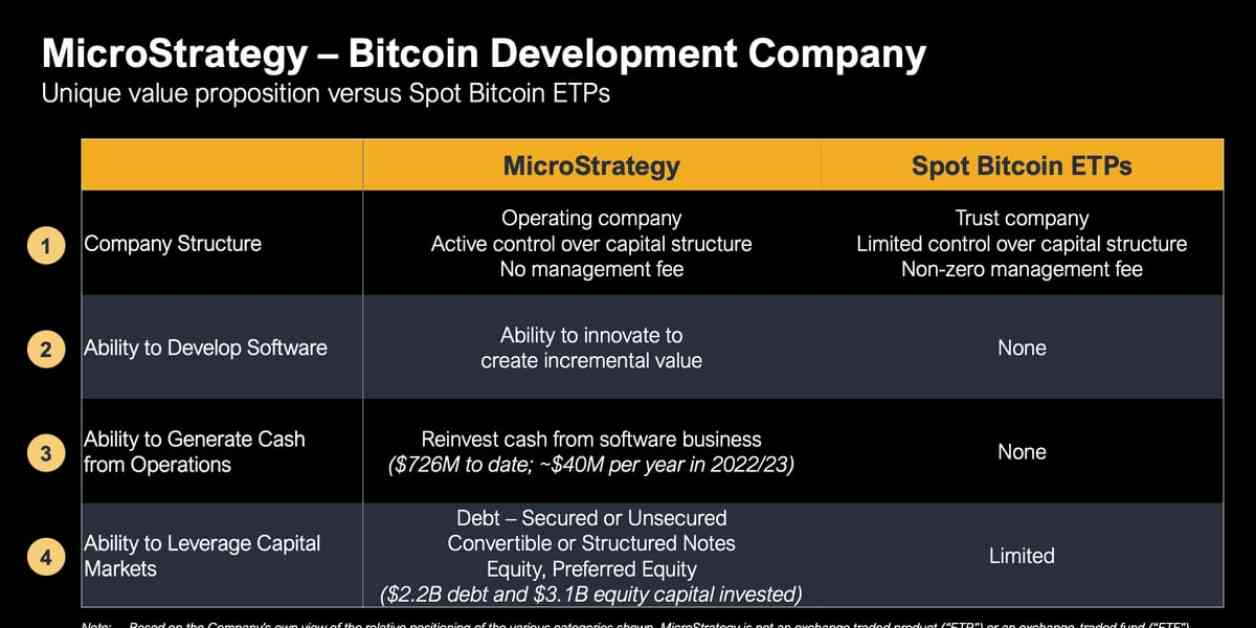

One key advantage of MicroStrategy’s long-term convertible debt strategy is that it provides the company with flexibility to capitalize on potential gains in bitcoin while managing liquidation risk. When the price of bitcoin rises, MicroStrategy can issue new debt, and conversely, when the value of the cryptocurrency falls, the company can issue new shares to reduce leverage. This balanced use of both equity and debt has been instrumental in the company’s success in the bitcoin market.

It is worth noting that MicroStrategy has not sold any of its bitcoin holdings since it began investing in the cryptocurrency. The company’s commitment to accumulating and holding bitcoin is expected to continue, with plans to raise additional capital for further purchases. Bernstein has expressed confidence in MicroStrategy’s strategy, giving the company an outperform rating on its stock with a price target of $2,890.

Despite fluctuations in the market, MicroStrategy’s shares have remained relatively stable, with only a minor change in trading price following the release of the report. The company’s innovative approach to bitcoin investing has garnered attention and praise from industry experts, positioning it as a leader in the evolving landscape of digital asset investment.

As the first company to actively pursue a bitcoin investment strategy on this scale, MicroStrategy’s impact on the capital markets is significant. By paving the way for institutional adoption of cryptocurrency, the firm is not only diversifying its own treasury but also setting a precedent for other companies to follow suit. With its forward-thinking approach and commitment to bitcoin, MicroStrategy continues to shape the future of finance in the digital age.