MADRID, 17 Ago. (EUROPA PRESS) –

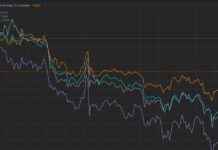

The Ibex 35 has broken its streak of eleven consecutive sessions in ‘green’, the best since March 2009, by registering a drop of 0.91% in the stock market session this Wednesday, which has led it to move away from the barrier of 8,500 points.

The selective Spanish has finished at 8,434.8 points in a day marked by the publication of the minutes of the last meeting of the Federal Reserve (Fed) of the United States and macroeconomic data.

While waiting to know the minutes of the Fed, investors have learned that the GDP of the eurozone grew in the second quarter of 2022 by 0.6% compared to the previous three months, when it had registered an expansion of 0.5% , according to the second reading of the data published by Eurostat, which lowers the first estimate by one tenth.

In the European Union as a whole, the rate of GDP growth also remained at 0.6%, despite the impact of the war in Ukraine. Compared to the second quarter of 2021, the progression of activity in the euro zone was 3.9% and 4% for the Twenty-seven.

In the United Kingdom, the year-on-year inflation rate stood at 10.1% last July, compared to 9.4% registered in June, which represents the largest increase in prices since 1982. It is the largest interannual inflation rate registered in a month of the current historical series, which began in January 1997.

In this context, the biggest falls were presented by IAG (-4.21%), Colonial (-3.32%), Fluidra (-2.59%), Arcelormittal (-2.29%), Telefónica (-2 .21%), Inditex (-2.05%), Meliá (-1.77%) and Acerinox (-1.77%).

On the positive side, only Corporación Acciona Energía (0.8%), Repsol (0.36%), Acciona (0.19%) and Iberdrola (0.05%) have closed.

The main European markets have also ended the day with falls, which have risen to 0.27% in London, 0.97% in Paris, 2.04% in Frankfurt and 1.04% in Milan.

The barrel of Brent quality oil, a reference for the Old Continent, stood at a price of 92.56 dollars, with an increase of 0.22%, while the Texas priced at 86.75 dollars, after rising 0. 25%.

In the foreign exchange market, the euro was exchanged at 1.0166 ‘greenbacks’, while in the debt market the risk premium was around 112 basis points, with the return on the 10-year Spanish bond at 2.22 %.