USDT under radar

Tether’s USDT has long been the darling of the stablecoin market, but recent regulatory changes and mounting competition are starting to chip away at its dominance. The European Union’s Markets in Crypto-Assets regulations, or MiCA, have shaken up the status quo, requiring stablecoin issuers like Tether to make significant changes to comply with the new rules.

The turning point came on December 30, 2024, when MiCA went into full effect, ushering in a new era for stablecoins in the EU. Tether, in particular, has felt the impact of these regulations, facing increased redemptions, regulatory hurdles, and fierce competition from the likes of Circle’s USDC and Ripple’s RLUSD.

Tether’s CEO, Paolo Ardoino, has expressed concerns about the risks associated with the new regulations, but the market seems more focused on Tether’s dwindling market cap and the influx of redemptions leading up to MiCA’s implementation.

Competitors closing In: USDC and RLUSD’s strategic advances

As Tether struggles to adapt to the changing regulatory landscape, its competitors are seizing the opportunity to gain ground. Circle’s USDC, in particular, has emerged as a frontrunner in the stablecoin race, securing MiCA approval and forming strategic partnerships to expand its reach and market share.

Ripple’s RLUSD, a relative newcomer to the stablecoin scene, is also making waves with its innovative approach to compliance and integration with existing payment solutions. With Ripple’s strong foothold in the payments industry, RLUSD is well-positioned to become a major player in the stablecoin market.

Ripple’s big Moment as RLUSD gains momentum in a changing era

Ripple’s recent legal victories and strategic partnerships are setting the stage for RLUSD’s rapid adoption and growth. With regulatory uncertainties clearing up and a more crypto-friendly administration in the U.S., Ripple is poised to capitalize on the changing landscape and solidify its position in the stablecoin market.

What to expect next?

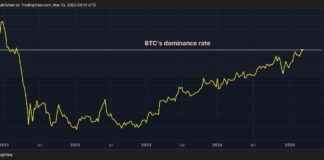

As the stablecoin market continues to evolve, investors and traders are keeping a close eye on the developments unfolding in the wake of MiCA and other regulatory changes. While USDT remains the dominant player for now, the rise of USDC and RLUSD signals a potential shift in the balance of power within the stablecoin ecosystem.

In the coming months, we can expect to see further regulatory developments, strategic partnerships, and market dynamics that will shape the future of stablecoins. Stay tuned as the stablecoin market continues to evolve and adapt to the changing regulatory environment.