US Equities Flash Caution Signal for Bitcoin: Crypto Daybook Americas

It’s still early in 2025, and already we’re seeing a significant divergence between bitcoin and the S&P 500. BTC is looking to secure a foothold above $100,000, with Deribit-listed options indicating a bullish bias. On the other hand, the S&P 500, known for providing risk-on/off cues to risk assets like BTC, is showing a greater downside risk according to Cboe data. This defensive positioning in stocks may be due to concerns surrounding President-elect Donald Trump’s upcoming inauguration on Jan. 20, with some predicting a potential “sell-the-news” event.

How will BTC react to this potential market shift? Expectations of regulatory clarity under Trump have already seen the cryptocurrency rally to over $100,000 from $70,000 in just two months. With a possible broader market sell-off on Jan. 20, driven by profit-taking and uncertainty, how will BTC fare? The answer remains uncertain, but several factors are currently supporting BTC.

Factors like liquidity returning to the market, capital flows from China finding a home in cryptocurrencies, and strong miner positions indicate a positive outlook for BTC. Moreover, traders are showing interest in ETH calls at high strikes despite ETH trading below $4,000. With over 70 of the top 100 coins by market value seeing gains in a 24-hour period, the market is showing signs of risk-on sentiment.

However, the bond market rout, especially in Japan and the UK, is spreading outside the US and could impact risk assets globally. As the market remains volatile and uncertain, it’s crucial to stay alert and monitor developments closely.

Derivatives Positioning

In the derivatives market, BTC and ETH basis on the CME are stable, with open interest increasing but not reaching record highs. Perpetual funding rates for the broader market remain around 10% annually, with calls trading pricier than puts. A recent large block trade leaned bearish, suggesting a cautious approach among some traders.

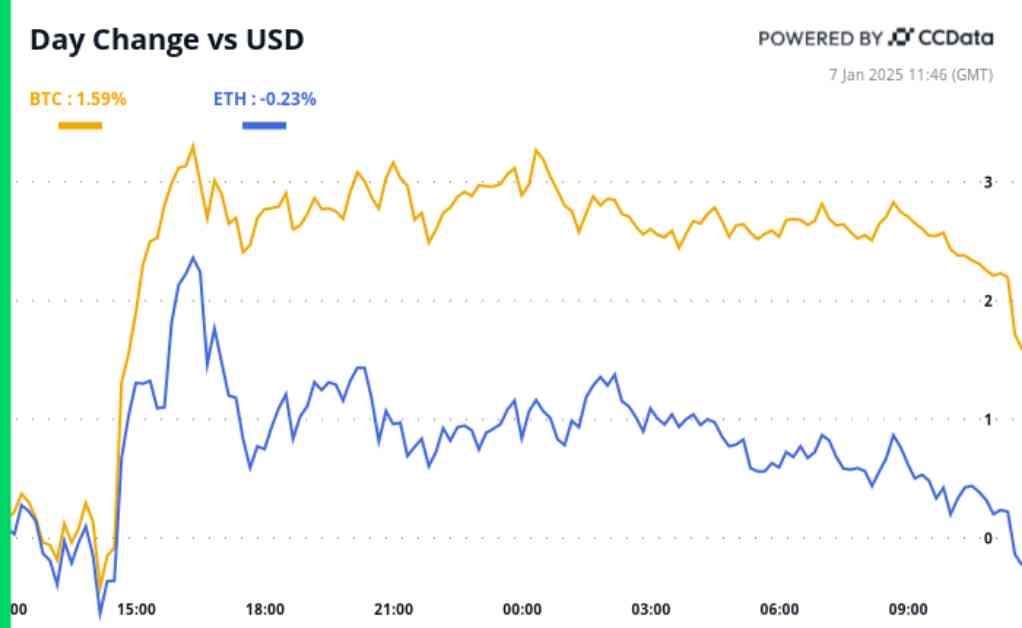

Market Movements

BTC is currently down slightly from Monday, trading at $101,428.11, while ETH is also down at $3,658.61. The CoinDesk 20 index is showing a slight decline, but certain metrics like the CESR Composite Ether Staking Rate are up.

When it comes to traditional markets, the DXY is down, gold and silver are up, and major indices like the Nikkei 225 and Nasdaq are showing mixed movements. The bond market is also seeing fluctuations, with implications for risk assets.

Investors and traders are closely monitoring these developments to navigate the volatile market landscape effectively. As the year progresses, keeping a watchful eye on key indicators and market movements will be crucial for making informed decisions in the ever-changing financial landscape.