Bitcoin Plunge Leads to $1 Billion in Liquidations

In a shocking turn of events, the cryptocurrency market experienced a significant downturn as Bitcoin, the leading digital asset, plummeted from a record high above $103,000 to nearly $92,000 in a matter of hours. This sudden drop in price triggered a cascade of liquidations across various futures contracts, resulting in over $1 billion in losses for traders within just 24 hours.

Impacts on Other Cryptocurrencies

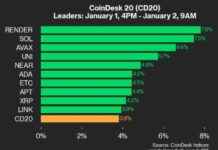

The fallout from Bitcoin’s nosedive was felt most acutely in futures contracts tracking other major tokens, such as XRP and Dogecoin. XRP futures saw a staggering $39 million in losses, while Dogecoin futures also recorded substantial liquidations totaling $50 million. These losses were a direct result of the rapid reversal in prices for these tokens following a prolonged rally that had driven open interest on their futures to record highs.

Understanding Liquidations in the Crypto Market

Liquidations in the crypto market occur when an exchange forcibly closes a trader’s leveraged position due to a failure to meet margin requirements. This can happen when a trader’s initial margin is partially or completely lost, leading to the closure of their position. In this recent case, over 156,000 individual traders were liquidated, with the largest single liquidation order amounting to $18 million on the OKX exchange.

Expert Analysis and Market Sentiment

Shaurya Malwa, a prominent figure in the crypto space, highlighted the significance of these liquidations and their impact on market sentiment. The fear and greed sentiment index, a key indicator of market psychology, shifted from “extreme greed” to “greed” following the sudden market downturn. This shift in sentiment reflects a broader sense of uncertainty and caution among market participants, signaling a potential shift in market dynamics.

In conclusion, the recent events in the cryptocurrency market have underscored the inherent volatility and risk associated with trading digital assets. As traders navigate these turbulent waters, it is crucial to stay informed, exercise caution, and approach trading with a clear understanding of the risks involved.