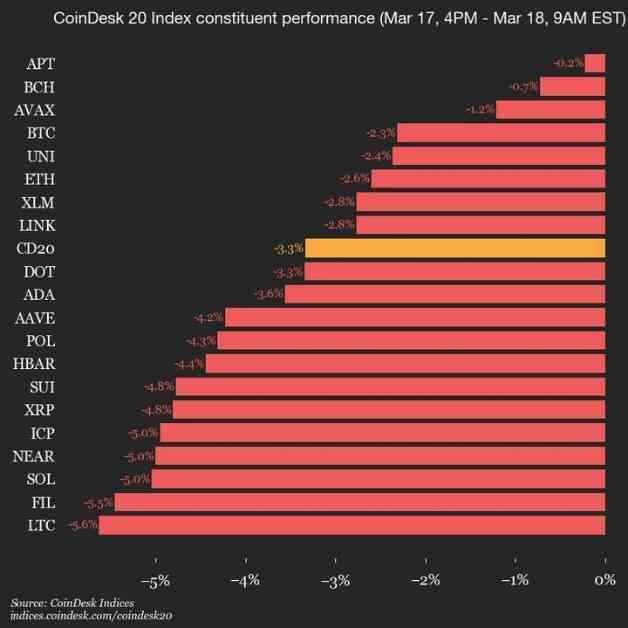

The latest market update from CoinDesk Indices reveals a notable 3.3% drop in the CoinDesk 20 Index, with assets trading lower across the board. Litecoin (LTC) experienced a significant decline of 5.6%, while Filecoin (FIL) followed closely behind with a 5.5% decrease, contributing to the overall downward trend. This data was reported on March 18, 2025, at 1:11 p.m. UTC, shedding light on the shifting landscape of the cryptocurrency market.

Understanding the CoinDesk 20 Index

The CoinDesk 20 Index serves as a barometer for the performance of various digital assets, providing a comprehensive overview of market dynamics on a daily basis. As of the latest update, the index sits at 2571.75, reflecting a 3.3% decline of -88.79 points since the previous trading session at 4 p.m. ET on Monday. Notably, none of the 20 assets included in the index showed positive movement, underscoring the widespread decrease in value across the cryptocurrency spectrum.

Among the assets featured in the CoinDesk 20 Index, some emerged as leaders and others as laggards in terms of performance. APT demonstrated relative resilience with a modest decline of -0.2%, while BCH also fared better than average with a decrease of -0.7%. On the other end of the spectrum, LTC and FIL stood out as notable laggards, experiencing substantial drops of 5.6% and 5.5%, respectively. These contrasting movements highlight the diverse outcomes within the cryptocurrency market, where fluctuations can vary widely based on individual asset performance.

Global Impact and Market Dynamics

The CoinDesk 20 Index is a widely recognized benchmark that is traded on multiple platforms across various regions worldwide, capturing the pulse of the global cryptocurrency landscape. The interconnected nature of digital assets means that market movements in one region can have ripple effects on a global scale, influencing investor sentiment and trading behavior. As such, fluctuations in the CoinDesk 20 Index reverberate throughout the broader cryptocurrency market, shaping trends and shaping investment strategies for participants around the world.

In light of the recent downturn in the CoinDesk 20 Index, investors and analysts are closely monitoring market dynamics to assess potential drivers behind the decline. While individual asset performance can be influenced by a myriad of factors, including market sentiment, regulatory developments, and macroeconomic trends, the overall trajectory of the index reflects broader trends within the cryptocurrency ecosystem. As volatility remains a defining characteristic of digital assets, market participants are advised to exercise caution and conduct thorough research before making investment decisions in this dynamic and evolving landscape.

As the cryptocurrency market continues to evolve and adapt to changing conditions, the CoinDesk 20 Index serves as a valuable tool for tracking trends and assessing relative performance across a diverse range of digital assets. By providing a comprehensive snapshot of market movements on a daily basis, the index offers insights into the underlying dynamics shaping the landscape of digital currencies, offering a window into the ever-changing world of cryptocurrencies and blockchain technology.