Deribit Surpasses $1 Trillion in Crypto Trading Volume in 2024

Deribit Makes Waves with Record-Breaking $1 Trillion Crypto Trading Volume in 2024In a significant milestone for the crypto market, Deribit, the leading crypto exchange,...

Bitcoin ETFs See Increased Inflows After Trump Inauguration; BTC Price Above...

Bitcoin ETFs Experience Surge in Inflows Post Trump InaugurationBitcoin exchange-traded funds (ETFs) in the United States have witnessed a significant surge in inflows following...

Ontario Teachers’ Pension Plan Lawsuit: FTX Losses Update and Analysis

Ontario Teachers' Pension Plan Faces Lawsuit Over FTX LossesOntario Teachers’ Pension Plan (OTPP) is currently embroiled in a legal battle following a...

Bringing Trump Memecoin to Institutions: Rex and Osprey Launch New Crypto...

**Bringing Trump Memecoin to Institutions: Rex and Osprey Launch New Crypto ETF**Investment management firms Rex Shares and Osprey Funds are making waves in the...

SEC Acting Chair Uyeda Initiates Crypto Task Force for Regulation

**SEC Acting Chair Uyeda Launches Crypto Task Force to Address Regulation Challenges**In an effort to tackle the regulatory uncertainty surrounding cryptocurrencies, the U.S. Securities...

Bitcoin Brand Floki Lands Major Ad Deal in Rugby Super League

Floki's Game-Changing Advertising Deal in Rugby Super LeagueMiami, Florida, January 21st, 2025, Chainwire - In a groundbreaking move that is set to revolutionize the...

Ether-Bitcoin Ratio Faces Decline as Trump Omits BTC in Inaugural Speech

ETH-BTC Ratio Declines After Trump's SpeechThe latest market trends are pointing towards a decline in the ether-bitcoin ratio after President Donald Trump's recent inaugural...

Trump Family Meme Coins Cause Decline in Whale Population

Trump Family Meme Coins: A Disaster for WhalesIn a shocking turn of events, the launch of Trump family meme coins has not only rocked...

Powerloom Launches L2 Chain Mainnet: Everything You Need to Know

Powerloom Launches L2 Chain Mainnet: A Game-Changer for Web3Powerloom, a revolutionary open composable data layer for Web3 applications, has officially launched its mainnet on...

The Impact of Donald Trump’s Inauguration Speech on Bitcoin (BTC)

**The Impact of Donald Trump's Inauguration Speech on Bitcoin (BTC)**Bitcoin Fades From Highs After No Crypto Mentions During Trump's Inauguration SpeechPresident Donald Trump's inauguration...

Caroline Pham: Trump’s Pick for Acting CFTC Chair

President Donald Trump has appointed CFTC Commissioner Caroline Pham as the acting chair of the Commodity Futures Trading Commission, marking a significant development in...

El Salvador Bitcoin Reserve Adoption: Impact on Growing Blockchain | Live...

Bitcoin Surges Above $100k as El Salvador Boosts BTC ReservesBitcoin has once again surpassed the crucial $100k mark, sending shockwaves through the markets amid...

Balaji Ravages Memecoins, Denounces $TRUMP Token as Market Goes Wild

Former Coinbase CTO Warns Against MemecoinsBalaji Srinivasan, the former CTO of Coinbase and general partner at venture capital firm Andreessen Horowitz, recently made waves...

Bitcoin ETF Inflows Soar 475% Before Trump’s Inauguration

Bitcoin ETF Inflows Skyrocket 475% Before Trump's InaugurationIn a stunning turn of events, inflows into U.S. spot Bitcoin exchange-traded funds saw a jaw-dropping surge...

Elluminex: Harnessing the Potential of a Blockchain with Over 950 Million...

How Elluminex Redefines DEXsIn a groundbreaking move that is set to revolutionize the world of decentralized finance (DeFi), Elluminex is poised to challenge the...

The Ultimate Guide to YouTube Video Downloaders: Frequently Asked Questions Answered

YouTube has become one of the largest platforms for video content, offering millions of videos across various genres. Sometimes, you might want to download...

Solana Price Soars to $275 with Donald Trump’s Token Surging to...

Breaking News: Solana Price Hits $275 as Trump's Memecoin Surges to $8 BillionIn a surprising turn of events, Solana's price has reached an all-time...

Rising Meme Coin: Potential x1000 Growth Success Story

Breaking News: Catzilla Meme Coin Set to Conquer Crypto MarketIn the fast-paced world of cryptocurrency, a new player has emerged, ready to disrupt the...

MAGAVERSE Donates $1 Million to Trump-Endorsed Organizations: Bezos and Zuckerberg Matched

MAGAVERSE's Million-Dollar Donation Shakes Up the Crypto and Political WorldsIn a surprising turn of events, Solana-based meme coin MAGAVERSE has made waves...

TRUMP Memecoin Update: How Early Buyers Became Millionaires

TRUMP Memecoin Update: Early Buyers Strike GoldIn a whirlwind of confusion and excitement, early buyers of the 'official' memecoin linked to Republican Donald Trump...

Did Official Trump’s Support Cause Solana Volume to Reach Record Highs?

**Did Trump's Support Cause Solana Volume to Skyrocket?**Solana, a prominent name in the decentralized exchange (DEX) industry, saw its volume hit an all-time high...

Trump Signs Executive Order Declaring Crypto a National Priority

**Trump Signs Executive Order Declaring Crypto a National Priority**President Donald Trump has signed an executive order declaring cryptocurrency a national priority, signaling a significant...

Bitcoin Education Vital for Adoption in El Salvador: BTC Office Director

El Salvador’s Bitcoin Education Program: A Game ChangerEl Salvador made waves globally in 2021 when it became the first country to adopt Bitcoin as...

Lancashire Police Recovers £28m in Bitcoin Fraud from Australian Crypto Exchange

£28m Bitcoin Fraud Uncovered in LancashireIn a groundbreaking investigation, Lancashire Police has successfully recovered £28 million in assets from an international Bitcoin fraud gang...

Global Crypto Leaders Convene at Blockchain Forum 2025 in Moscow

**Global Crypto Leaders Convene at Blockchain Forum 2025 in Moscow**The 14th Blockchain Forum is just around the corner, set to take place in the...

Trump’s Return Sparks Hope for New Era with Crypto Ball Celebration

Trump's Return Sparks Hope for New Era with Crypto Ball CelebrationIn a glitzy display of wealth and power, crypto leaders gathered in Washington for...

Uncovering the Top Dark Web Cybercrime Forum in the Crypto World

Uncovering the Top Dark Web Cybercrime Forum in the Crypto WorldAs we dive into the murky depths of the dark web, we uncover a...

Polkadot Rollup: Hyperbridge Extends Initial Relayer Offering, Sells 52 Million Tokens

Hyperbridge Extends Initial Relayer Offering, Sells 52 Million TokensIn an exciting development in the world of blockchain technology, Hyperbridge, based in Zurich, Switzerland, has...

Ethereum ‘Pectra’ Upgrade Scheduled: What You Need to Know

Ethereum's 'Pectra' Upgrade: A Game-Changer for the Blockchain WorldEthereum enthusiasts, get ready to mark your calendars! The highly anticipated Pectra upgrade is...

Honoring the First Bitcoin President: MARA Mines ‘Trump 47’ Block

**Honoring the First Bitcoin President: MARA Mines 'Trump 47' Block**Publicly-traded Bitcoin mining company Marathon Digital Holdings has made headlines by announcing the mining of...

Top 3 Coins to Add to Your 2025 Portfolio for Success

XRP Coin Set For Continued Bullish Run With Stablecoin DebutIn the fast-paced world of cryptocurrency investing, the key to success lies in identifying the...

Litecoin (LTC) ETF Potential: Is It the Next Cryptocurrency to Watch?

**Litecoin (LTC) ETF Potential: The Next Big Thing in Cryptocurrency**In the fast-paced world of cryptocurrency, all eyes are on litecoin (LTC) as it potentially...

Upbit Faces Potential Sanctions in South Korea

**Upbit Faces Potential Sanctions in South Korea**South Korea’s largest cryptocurrency exchange, Upbit, is under scrutiny for possible violations of financial regulations in the country....

XRP Price Surges to $5 as SEC Appeal Heats Up, BYDFi...

XRP Price Surges to $5 as SEC Appeal Heats Up, BYDFi Remains Popular ChoiceVictoria, Seychelles, January 16th, 2025, Chainwire: In a stunning turn of...

Sony Launches Blockchain Protocol Amid Controversy: What You Need to Know

Sony Launches Blockchain Protocol Amid Controversy: What You Need to KnowSony, the 78-year-old Japanese electronics giant, has made waves in the cryptocurrency world by...

Onchain Economy ETF: VanEck Files for SEC Approval

VanEck’s Bold Move into Digital Asset InvestmentOn January 15, 2025, VanEck, a prominent asset management company, made a significant move by filing an application...

BTCS Partners with Rocket Pool to Increase Validators and Boost Margins

BTCS Partners with Rocket Pool to Enhance Blockchain OperationsSilver Spring, United States, Maryland, January 15th, 2025, Chainwire - In a groundbreaking move, BTCS Inc....

Asia’s Unique Approach to Web3: Insights from ARC’s Elroy Cheo

Asia's Unique Approach to Web3: Insights from ARC's Elroy CheoElroy Cheo, co-founder and architect of influential Web3 collective ARC, is on a mission to...

Sony’s Soneium Layer-2 Network: Controversy Surrounding Censorship Concerns

Sony's Soneium Network: The Controversy UnfoldsSony, the Japanese multinational giant, has made waves in the blockchain world with the launch of Soneium,...

Lido Impact Staking: Ethereum Staking for Social Impact | Live Bitcoin...

Lido Impact Staking: A Game-Changer in PhilanthropyLondon, United Kingdom, January 15th, 2025, Chainwire - Lido Impact Staking (LIS) is making waves in the world...

Cryptocurrency Traders Await CPI Report: DOGE and XRP Outperform Bitcoin’s Price...

Cryptocurrency Traders Await CPI Report: DOGE and XRP Outperform Bitcoin's Price ReboundDogecoin and XRP are leading the charge in the cryptocurrency market as traders...

Satoshi Action Fund Raises $300k for Bitcoin Advocacy

Satoshi Action Fund Raises $300k for Bitcoin AdvocacyIn a recent tweet, Dennis Porter, the CEO, and co-founder of the Satoshi Action Fund...

Pasco Pastor Indicted in Multi-Million Dollar Crypto Scam: What Happened?

Former Pasco Pastor Indicted in Multi-Million Dollar Crypto ScamFormer Pastor Francier Obando Pinillo of Pasco, Washington, finds himself at the center of a multi-million...

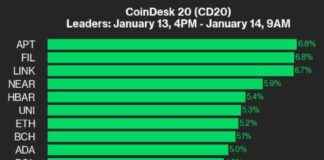

Crypto Market Update: APT and FIL See 6.8% Gain, All Assets...

Crypto Market Update: APT and FIL Lead with 6.8% GainIn the latest Crypto Market Update, Aptos (APT) and Filecoin (FIL) emerged as top performers,...

Top 4 Low-Cost Altcoins with High Growth Potential Like SOL

Top 4 Low-Cost Altcoins with High Growth Potential Like SOLIn the ever-evolving world of cryptocurrencies, investors are always on the lookout for the next...

Sonic Labs Launches New Points Program to Boost DeFi Growth and...

Sonic Labs Launches New Points Program to Boost DeFi Growth and User RewardsGeorge Town, Cayman Islands, January 14th, 2025, ChainwireSonic Labs has unveiled an...

The Importance of Investor Protection and Enforcement in Today’s Market

The Importance of Investor Protection and Enforcement in Today's MarketIn the fast-paced world of cryptocurrency, the need for investor protection and enforcement has never...

The Impact of Usual Protocol on Revenue Generation Amid Redemption Function...

Can Usual’s Revenue Switch Deliver on Promises Amid Growing Concerns?The creators of the USUAL token and USD0 stablecoin ecosystem have recently launched the Revenue...

Moemate Launches $Mates Ecosystem with 6m+ Users on January 14th

Moemate Launches $MATES Ecosystem with 6m+ Users on January 14thWilmington, Delaware, January 13th, 2025, Chainwire - In the fast-evolving world of cryptocurrency, AI agents...

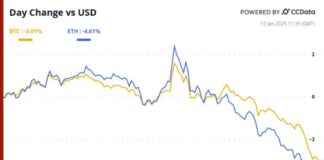

BTC Risks Losing Key Support Zone in Crypto Daybook Americas

Crypto Markets Face Uncertainty Amidst Risk-Off SentimentThe cryptocurrency market is facing a period of uncertainty as risk assets see a downturn. Bitcoin (BTC) is...

Bitcoin ATM Market Grows by 6% in 2024 Amid Rising Crypto...

Bitcoin ATM Market Grows by 6% in 2024 Amid Rising Crypto DemandBitcoin ATMs are on the rise globally, with their numbers spiking by 6%...

Bitcoin Correction: A Golden Opportunity for Investors to Accumulate

**Bitcoin Correction: A Golden Opportunity for Investors to Accumulate**Bitcoin is currently experiencing a decline that has caught the attention of many investors. With negative...

Revolutionizing Bitcoin ZK Tech: Babylon Labs’ Bridge to Cosmos

Revolutionizing Bitcoin ZK Tech: Babylon Labs' Bridge to CosmosBabylon Labs, the developer behind the largest BTC staking protocol, is making waves in...

CEO of Wolf Capital Admits Guilt in $9.4m Crypto Fraud Case

**CEO of Wolf Capital Admits Guilt in $9.4m Crypto Fraud Case**Travis Ford, 35, the CEO of Wolf Capital Crypto Trading LLC, based in Glenpool,...

FastBull Finance Summit Dubai 2025: Global Vision Leading Financial Frontiers –...

FastBull Finance Summit Dubai 2025: A Global Vision Leading Financial FrontiersThe FastBull Finance Summit is set to make its grand debut in Dubai on...

Kenya Legalizes Cryptocurrencies: Policy Shift Report

**Kenya Legalizes Cryptocurrencies: Policy Shift Report**In a groundbreaking move, Kenya's Treasury Cabinet Secretary, John Mbadi, has announced plans to legalize cryptocurrencies, marking a significant...

Top trading strategies for maximizing gains with Floki, Bonk, and Lightchain...

Maximizing Gains with Floki, Bonk, and Lightchain AIAmidst the tumultuous world of cryptocurrency trading, three names have emerged as potential game-changers: Floki, Bonk, and...

PropiChain: The AI Altcoin to Watch in 2025 Alongside XRP

**PropiChain: The Future of Real Estate Investment**In the fast-evolving world of cryptocurrency, the emergence of innovative projects like PropiChain (PCHAIN) is reshaping the landscape...

High Net-Worth Investors’ Strong Confidence in Bitcoin Sparks Bullish Sentiment

High Net-Worth Investors Bet Big on BitcoinIn a market where traders are cautious, high net-worth individuals are showing unwavering confidence in Bitcoin, sparking a...

New Token Aiming for 1,200x Growth to Challenge SUI and ADA

Unleashing Catzilla: The Meme Coin RevolutionIn a world where the crypto market is constantly evolving, a new player has emerged to shake things up...

Exploring Indie Game Development in Web3 and the Polkadot Ecosystem

Blockchain Technology Revolutionizes Indie Game Development in Web3In a groundbreaking new documentary, viewers are taken on a journey into the world of indie game...

Stablecoin Regulation Urged by Biden’s Consumer Watchdog Ahead of Trump Administration

Stablecoin Regulation Urged by Biden's Consumer Watchdog Ahead of Trump AdministrationIn a bold move just days before the transition of power to the Trump...

XRP Price Prediction: Will XRP Reach $50 by 2025?

Lunex Network: The Rising Star in the Crypto WorldIn the fast-paced world of cryptocurrency, the question on everyone's mind is whether XRP will reach...

Which Cryptocurrency Should You Buy for 1000x Returns? ChatGPT Reveals Surprising...

ChatGPT Reveals WallitIQ (WLTQ) as Top Cryptocurrency for 1000x ReturnsIn the fast-paced world of cryptocurrencies, predicting which token will yield extraordinary returns can be...

DeFi Platform Faces Backlash: Protocol Update Sparks Sell-Off

**DeFi Drama Unfolds: Usual Protocol Faces Backlash Over Protocol Update**In a shocking turn of events, the Usual Protocol, a rising star in the decentralized...

Donald Trump Makes History by HODLing Meme Coins

Donald Trump Makes History by Holding Meme CoinsGOP leader and billionaire businessman Donald Trump has made headlines by becoming the first sitting U.S. President...

ChainGPT (CGPT) Listed on Binance: Revolutionizing AI-Powered Blockchain Solutions

ChainGPT (CGPT) Revolutionizes AI-Powered Blockchain Solutions on BinanceIn a groundbreaking move for the blockchain and AI industries, ChainGPT (CGPT) has been listed on Binance,...

Bitcoin Price Analysis: BTC Chart Shows Longest Streak of 14 Green...

Bitcoin Price Analysis: BTC Chart Shows Longest Streak of 14 Green Hourly Candles Since 2017In a surprising turn of events, Bitcoin (BTC) has seen...

Top Cryptocurrency Picks Expected to Outperform SHIB, SOL, and XRP by...

**Rollblock Revolutionizes GambleFi with Blockchain Transparency**Rollblock, a rising star in the GambleFi sector, is poised to revolutionize the industry with its blockchain-backed transparency, surpassing...

NORDEK’s Dual-Anchored Blockchain: Redefining Bitcoin’s Global Economic Role

Title: NORDEK's Hybrid Blockchain Revolutionizing Bitcoin's Role in the Global EconomyBitcoin, the revolutionary digital currency, has been making waves in the global economy with...

Polymarket Customer Data Subpoenaed by US CFTC from Coinbase

**Polymarket Customer Data Subpoenaed by US CFTC from Coinbase**The U.S. Commodity Futures Trading Commission is seeking information about customers' interactions with the prediction market...

The Rise of RLUSD and USDC: Is USDT Losing Ground in...

USDT under radarTether’s USDT has long been the darling of the stablecoin market, but recent regulatory changes and mounting competition are starting to chip...