Scroll’s SCR token has experienced a significant drop of 32% in value within just over 24 hours since its launch. This decline comes as the total value locked on the network has also fallen by 24% in the past week, leading to frustration among investors regarding the token supply. The top 10 recipients of the airdrop received 11.7% of the total drop, highlighting concerns about the distribution of tokens.

Following its debut at $1.40, the SCR token is now trading at $0.94, marking a substantial decrease in its market cap to below $180 million. Despite initial excitement surrounding Scroll’s governance token launch and its potential to excel in the Ethereum scaling race, the token has dropped out of the top 250 tokens on CoinMarketCap.

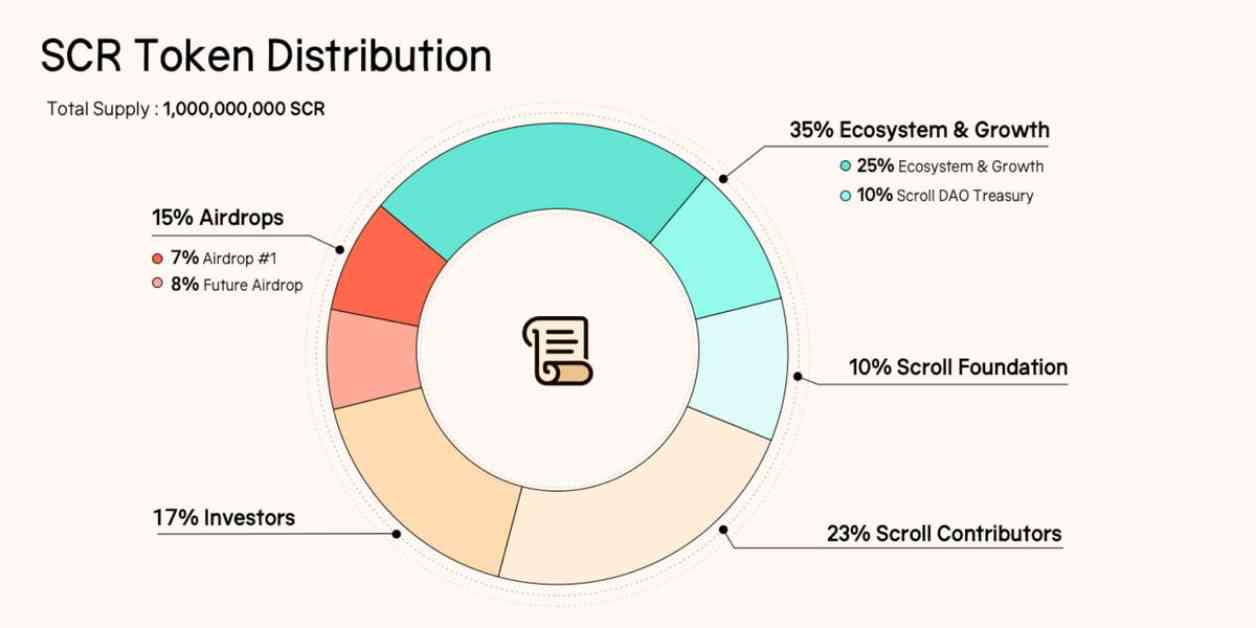

The decline in Scroll’s token performance may not necessarily indicate a failing project, as many newly released tokens struggle during the initial phase of price discovery. However, the issues faced by Scroll seem to be related to token allocation and distribution problems. Users had expressed frustration prior to the token’s release due to the allocation of 5.5% of the supply to the Binance Launchpool and just 7% for the initial airdrop.

This frustration was exacerbated by the revelation that Scroll did not set a cap on the airdrop, allowing a few large investors to acquire a significant portion of the available tokens. Andrew10Gwei noted that the top 10 wallets would receive 11.7% of the airdrop, while the top 100 wallets would receive 34.4%. This unequal distribution could hinder the token’s ability to sustain a price rally, as demand may not keep up with the selling pressure from large holders.

Scroll’s airdrop campaign rewarded early adopters and users with “marks” that could be converted into an airdrop. While this method is common in the crypto space, the absence of fixed allocation bands or a maximum cap has led to an imbalance in token supply. As a result, the project faces challenges in convincing large holders to hold onto their tokens and attracting new investors who believe in the token’s potential for future growth.

Points farming, the practice of moving capital to different projects to participate in airdrops, can also impact a project’s long-term sustainability. While it may initially boost activity, there is often little incentive for investors to hold onto the token once the airdrop is distributed, leading to potential sell-offs.

Scroll’s team has yet to address concerns about implementing a maximum airdrop cap, and it remains to be seen how they will navigate these challenges in the short term. As the project works to regain investor confidence and stabilize its token price, addressing issues related to token distribution and allocation will be crucial for its long-term success.