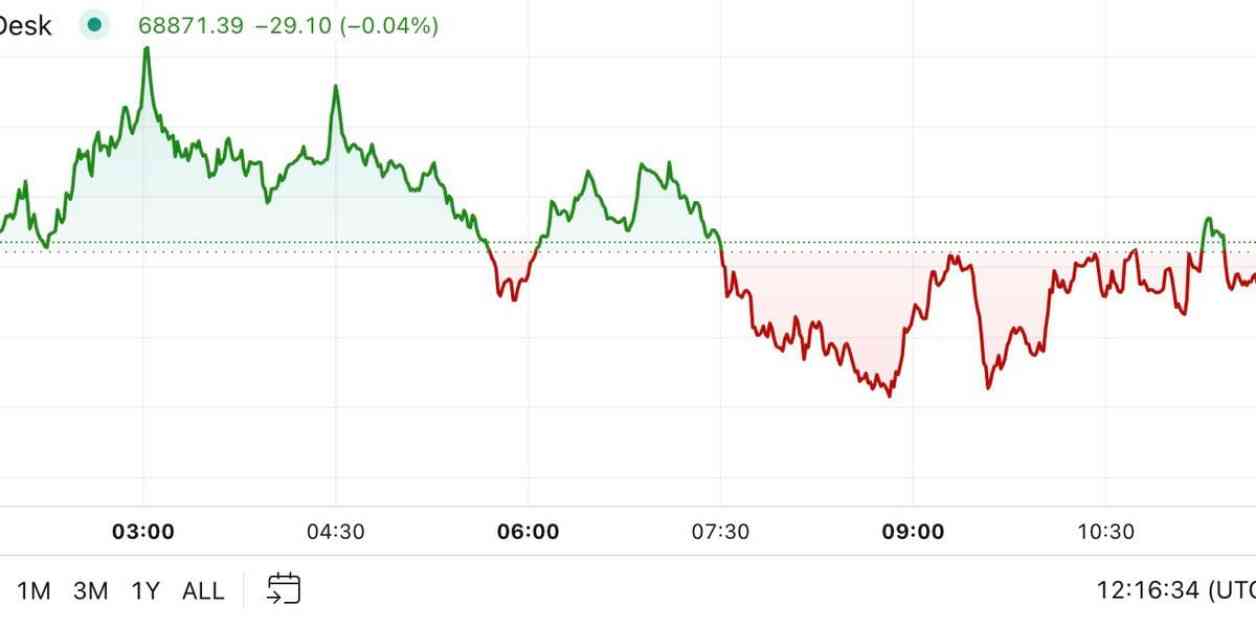

Bitcoin and other major cryptocurrencies remained stable on the eve of the U.S. presidential election. Bitcoin’s price edged closer to $69,000, showing a 0.8% increase in the last 24 hours. The overall digital asset market saw a more subdued rise of less than 0.5%. After coming close to reaching a new all-time high last week, bitcoin experienced a slight dip to $67,600 on Sunday, possibly in response to a decrease in the likelihood of a pro-crypto Donald Trump victory. As the countdown to the election begins and uncertainty looms, traders seem to be adopting a wait-and-see approach before making any significant moves.

Market sentiment seems to be favoring Democrat Kamala Harris as her winning odds continue to climb on the Polymarket betting platform. Traders have been actively trading shares, driving up the price of Harris’ winning shares to 43 cents, up from 33 cents on October 30. On the other hand, shares of Republican Donald Trump have declined from 66 cents to 57 cents. While polling data from Real Clear Polling indicates a narrow lead for Trump at 48.5% to 48.4%, trading activity suggests that investors are hedging their bets and preparing for various outcomes.

In a separate development, Singapore’s central bank, the Monetary Authority of Singapore (MAS), announced plans to introduce new measures to promote tokenization in financial services. MAS aims to establish commercial networks to enhance liquidity of tokenized assets, develop market infrastructures, create industry frameworks for tokenized assets, and provide access to settlement facilities for tokenized assets. The move is intended to facilitate the deployment of tokenized capital markets products and promote the growth of tokenized markets on a broader scale.

Looking at the broader economic landscape, a chart comparing U.S. 10-year note yields, three-month bill yields, the spread between the two, and the S&P 500 since 1985 indicates interesting trends. The current spread between the yields is on the verge of normalization or turning positive, which historically has been associated with downward trends in the S&P 500 and U.S. recessions. However, the current situation may not necessarily spell trouble for stocks and other risk assets, including cryptocurrencies. The recent de-inversion is accompanied by an increase in money supply, which typically signals a bullish trend for scarce digital assets like bitcoin, according to André Dragosch, Bitwise’s director and head of research for Europe.

In conclusion, the crypto market remains steady as investors await the outcome of the U.S. election. The fluctuating odds of the candidates, developments in tokenization initiatives, and macroeconomic trends all contribute to the current state of the market. As uncertainty prevails, traders and investors are closely monitoring the situation to make informed decisions in the days ahead.