Solana, a well-known blockchain platform, has recently reached an all-time high price of $260. This milestone was achieved as a result of increased interest in Solana’s crypto-related products, leading to a surge in the token price.

Several companies, such as Bitwise, VanEck, 21Shares, and Canary Capital, have proposed the creation of a Solana spot exchange-traded fund (ETF) to the Securities and Exchange Commission (SEC). This move follows the approval of Bitcoin and Ethereum spot ETFs earlier this year. With Bitcoin trading options from BlackRock and Grayscale, the price of Bitcoin has risen to $99k.

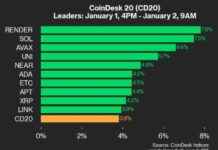

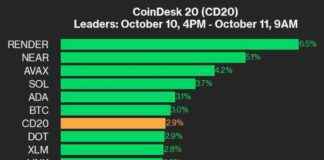

Following these developments, the price of SOL (SOL) surged by 11.12% in a single day, reaching $260. Over the past year, the token price has increased by 383%, bringing Solana to the 3rd position in terms of market capitalization, behind Tether (USDT) with $130 billion.

The market capitalization of the token has now reached $124 billion, and the trading volume has increased to $11.3 billion, representing a 75% increase in just one day. As of the time of writing, the price continues to rise and has reached $262.

According to DefiLlama on November 22, Solana’s total value locked (TVL) has increased by 3.17% in a day, reaching $8.74 billion. While this may not be the highest TVL recorded, the significant growth from just $353 million in October 2023 is noteworthy.

All top decentralized finance (DeFi) rankings within the Solana blockchain have seen daily increases ranging from 3.90% to 11.50%. Binance staked SOL (BNSOL) has also experienced significant growth, with a 333% increase in value over the past month.

As for the Solana ETF update, it is anticipated that a Solana ETF may be introduced in the United States stock market next year. Companies like Bitwise have already begun filing the necessary documents, alongside VanEck, 21Shares, and Canary Capital. However, the final decision on these filings may be influenced by the leadership of Gery Gensler in the SEC.

Gensler’s announcement of his resignation on November 21, prior to the start of Trump’s administration in January 2025, could signal potential changes in cryptocurrency regulation. The new government may adopt a more favorable stance towards digital asset development, which could further boost cryptocurrency prices in the future.