The current wave of volatility continues to affect Bitcoin ( TTC) as well as Ether ( ETH) prices. This is prompting traders to reevaluate their short-term expectations and go back to the drawing boards. The possibility of Bitcoin falling to $2,500 is increased by the fact that Ether fell below $2,900 support on February 17.

Data from Cointelegraph Markets Pro, TradingView show that Ether dropped to $2,752 intraday after it hovered near the $2900 support level during the morning trading hours.

Here are some thoughts from analysts about Ether’s price fall and whether more downside can be expected as global tensions rise.

The next stop for Ethereum could be $1700

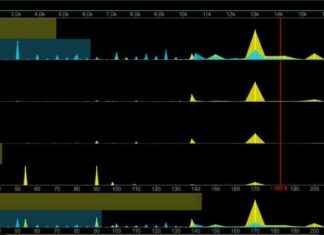

Crypto trader and pseudonymous Twitter User ‘Crypto Tony” provided a general overview of Ether’s current outlook. He created the following chart, which discusses the areas of support or resistance that you should be paying attention to.

Crypto Tony said.

“$3,900 is still my most important area and if you flip that, I believe the low is in… If we reject it or fail even to reach it, we will head towards my main goal of $1,700.”

The price is above a “supertrend” resistance level

Market analyst and pseudonymous Twitter User ‘IncomeSharks,’ offered a more bullish view on Friday’s price action. He posted this chart showing that Ether is currently at a significant resistance area.

According to the analyst

“Ether right at supertrend resistance. It’s more likely to break upwards than it is to flip bullish because it’s flat. If it flips bullish, I believe $2,900 to $3,000 is next.

Further downwards is projected by the macro trend

Pentoshi, a trader and pseudonymous user on Twitter, offered insight into what might happen to Ether, and the wider altcoin markets, if it fails to hold its current level.

Pentoshi stated,

“I will note that there is some local strength in this area since it has held its lows, but overall still lower highs. Trend is down. *IF* these lows break *THEN* *MOST* altcoins turbo nuclear.”

The total cryptocurrency market is now worth $1.899 trillion. Bitcoin’s dominance rate at 41.4%.