Bitcoin has been under significant selling pressure lately, and a recent on-chain data discovery has raised more concerns. A dormant Bitcoin wallet that had been inactive for 12 years suddenly transferred over $6.8 million in Bitcoin in two separate transactions. This has led to speculation that the whale behind this wallet may be looking to sell their tokens, adding to the selling pressure already facing Bitcoin.

The transactions from the dormant wallet (1Nxxi) involved moving 76 BTC ($4.46 million) and 43 BTC ($2.46 million) to an unknown address (3Ctd5). Interestingly, the 119 BTC transferred is still intact in the unknown address, which suggests that the whale may not be looking to offload their holdings immediately. This is a relief for the crypto community, as a massive sale could further impact Bitcoin’s price.

In addition to this whale activity, the German government has also been selling significant amounts of Bitcoin. Up to $175 million worth of Bitcoin has been moved to various exchanges, creating additional selling pressure in the market. Despite this, on-chain analytics suggest that some of these transactions are likely deposits for institutional services or over-the-counter trading.

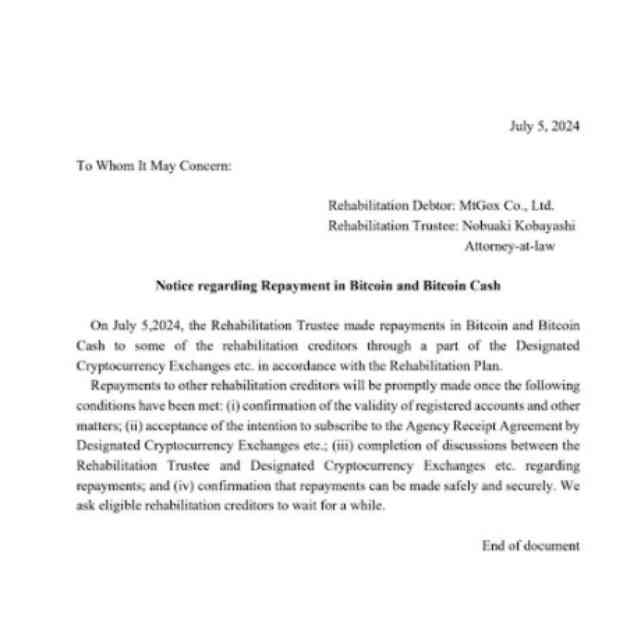

Moreover, the news of Mt. Gox beginning repayments to its creditors is set to add more selling pressure to the market. Mt. Gox, a defunct crypto exchange, is expected to repay its creditors up to $9 billion worth of crypto, with Bitcoin being the primary asset involved. This could lead to some creditors liquidating their holdings, affecting Bitcoin’s price in the near future.

As of the latest data, Bitcoin is trading at around $54,300, down over 7% in the last 24 hours. The market is closely watching these developments, as any significant sell-offs could further impact Bitcoin’s price dynamics. It is essential for investors to stay informed and conduct thorough research before making any investment decisions in such a volatile market.

In conclusion, the recent activities involving dormant wallets, government selling, and Mt. Gox repayments are putting pressure on Bitcoin’s price. The market remains uncertain, and investors need to be cautious and prepared for potential fluctuations. Stay tuned for more updates on the evolving crypto market landscape.