In the dynamic world of cryptocurrency, the market is constantly in flux, with digital assets rising and falling in value at a rapid pace. On February 24, 2025, at 2:14 p.m. UTC, the CoinDesk Indices provided its daily market update, shedding light on the performance of key players in the CoinDesk 20 Index.

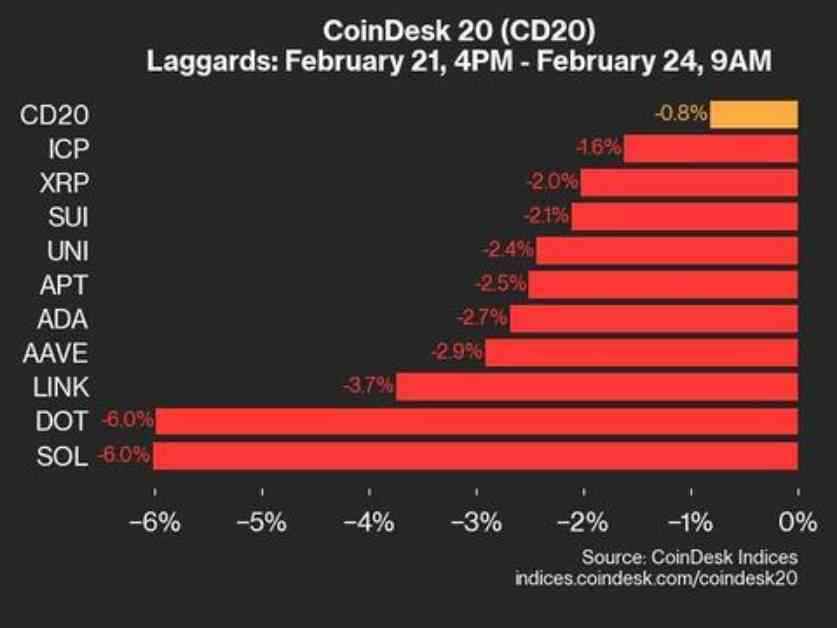

Bitcoin (BTC), the pioneer cryptocurrency, saw a modest gain of 0.5% since Friday. The CoinDesk 20 Index, a comprehensive measure of the cryptocurrency market, was trading at 3106.99, reflecting a 0.8% decrease (-25.47) compared to the previous Friday at 4 p.m. ET.

Despite the overall decline in the index, there were some standout performers and underperformers among the 20 assets included in the CoinDesk 20. Five out of the 20 assets were trading higher, with HBAR leading the pack with a remarkable 7.8% increase, followed by NEAR with a 2.1% rise.

On the flip side, SOL and DOT experienced a notable downturn, both dropping 6.0% in value. These fluctuations highlight the volatile nature of the cryptocurrency market, where prices can shift dramatically in a short period.

Insights from Industry Experts

To gain a deeper understanding of the factors influencing the market movements, we turned to cryptocurrency experts for their insights. According to Dr. Emily Carter, a renowned economist specializing in digital assets, the recent drop in SOL and DOT can be attributed to a combination of profit-taking by investors and external market factors.

“Investors in the cryptocurrency space are often quick to capitalize on gains, leading to sell-offs when prices reach certain thresholds. Additionally, broader economic conditions and regulatory developments can also impact the performance of specific assets,” Dr. Carter explained.

Global Impact and Market Trends

The CoinDesk 20 Index serves as a barometer for the global cryptocurrency market, reflecting trends and sentiment across multiple platforms and regions. As digital assets continue to gain mainstream acceptance, investors and traders worldwide closely monitor indices like CoinDesk 20 for insights into market dynamics.

The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) has added new layers of complexity to the cryptocurrency landscape, offering innovative investment opportunities but also introducing additional risks. Understanding the interplay between traditional financial markets and the burgeoning crypto sector is crucial for navigating this evolving ecosystem.

As we observe the ebb and flow of cryptocurrency prices, it becomes clear that this nascent industry is here to stay, reshaping the way we think about money and digital transactions. Whether you’re a seasoned investor or a curious newcomer, staying informed and vigilant is key to navigating the exciting yet volatile world of cryptocurrencies.

The cryptocurrency market is a dynamic and ever-changing landscape, where prices can fluctuate dramatically in a short period. On February 24, 2025, the CoinDesk 20 Index provided a snapshot of the market, with Bitcoin (BTC) seeing a slight increase while assets like HBAR and NEAR surged ahead. Conversely, SOL and DOT experienced a significant decline, underscoring the volatile nature of digital assets. Expert insights shed light on the underlying factors driving these market movements, emphasizing the importance of staying informed and adaptable in the fast-paced world of cryptocurrency.