Swiss National Bank Rejects Bitcoin as Reserve Asset

In a recent announcement, the Swiss National Bank (SNB) declared that Bitcoin will not be considered as a reserve asset. SNB President Martin Schlegel emphasized that cryptocurrencies lack essential qualities required for a stable currency system. According to reports, Schlegel outlined various drawbacks of cryptocurrencies, including their high market volatility, security vulnerabilities, and limited liquidity, making them unsuitable for reserve assets.

Schlegel Warns of Bitcoin’s Volatility and Financial Instability

One of the primary concerns highlighted by Schlegel is the excessive volatility of cryptocurrencies, which hinders their ability to provide reliable financial stability over an extended period. He emphasized that high liquidity in reserve assets is crucial for making swift monetary policy decisions, a requirement that cryptocurrencies currently do not meet. Additionally, Schlegel pointed out the security risks associated with cryptocurrencies due to their software-based nature, which makes them susceptible to bugs and cyber threats. These security issues pose significant risks that make cryptocurrencies unsuitable for inclusion in SNB’s reserve assets.

Swiss Bitcoin Supporters Push for Adoption as Swiss National Bank Stands Firm

Despite the SNB’s decision to reject Bitcoin as a reserve asset, Swiss Bitcoin supporters remain steadfast in their commitment to promoting Bitcoin adoption. A new initiative launched on December 31, 2024, aims to persuade the SNB to include Bitcoin in its official asset holdings. However, the proposed amendment requires 100,000 Swiss citizen signatures by June 30, 2026, to initiate the national voting process.

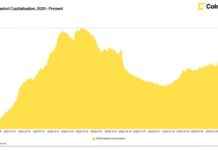

The Swiss National Bank has maintained a cautious approach towards digital asset acceptance from the outset. In November 2024, the bank acknowledged the expansion of cryptocurrencies while emphasizing their classification as a specialized market rather than a conventional financial instrument. Schlegel further supported this stance by noting that despite the significant growth in cryptocurrency market capitalization, it remains relatively small compared to the global financial markets.

Schlegel Dismisses Bitcoin as a Competitor to the Swiss Franc

Addressing concerns about competition between digital assets and the Swiss franc, Schlegel downplayed the issue, stating that competition among currencies is a common occurrence. He emphasized that the Swiss franc continues to be a highly sought-after asset, and the SNB is not worried about potential competition from cryptocurrencies. The Swiss National Bank remains firm in its current position, asserting that Bitcoin and other digital assets will not form part of Switzerland’s monetary reserves. However, with increasing public support for Bitcoin, the debate surrounding its inclusion may continue in the future.

In conclusion, the Swiss National Bank’s decision to reject Bitcoin as a reserve asset underscores the institution’s cautious approach towards digital currencies. While Bitcoin supporters continue to advocate for its adoption, the SNB remains steadfast in its stance, citing concerns about volatility, security risks, and liquidity limitations. The ongoing discussion surrounding Bitcoin’s role in Switzerland’s monetary reserves reflects the evolving landscape of digital assets and traditional financial systems.