Kanye West’s Memecoin Impact in Crypto Market: A Closer Look at the Latest Trends

Cryptocurrency enthusiasts and investors are abuzz with the recent developments in the crypto market, particularly following the transition of the U.S. Securities and Exchange Commission’s former crypto enforcement unit into the Cyber and Emerging Technologies Unit. This shift, along with dovish comments from Atlanta Fed President Raphael Bostic, has sparked a wave of optimism among market participants.

Renaming the Crypto Assets and Cyber Unit signifies a significant pivot away from the agency’s previous focus on crypto, which often resulted in regulatory challenges and legal disputes with key industry players. Armani Ferrante, founder, and CEO of BackPack, highlighted the potential for clearer regulations to attract institutional investors, thereby enhancing market infrastructure.

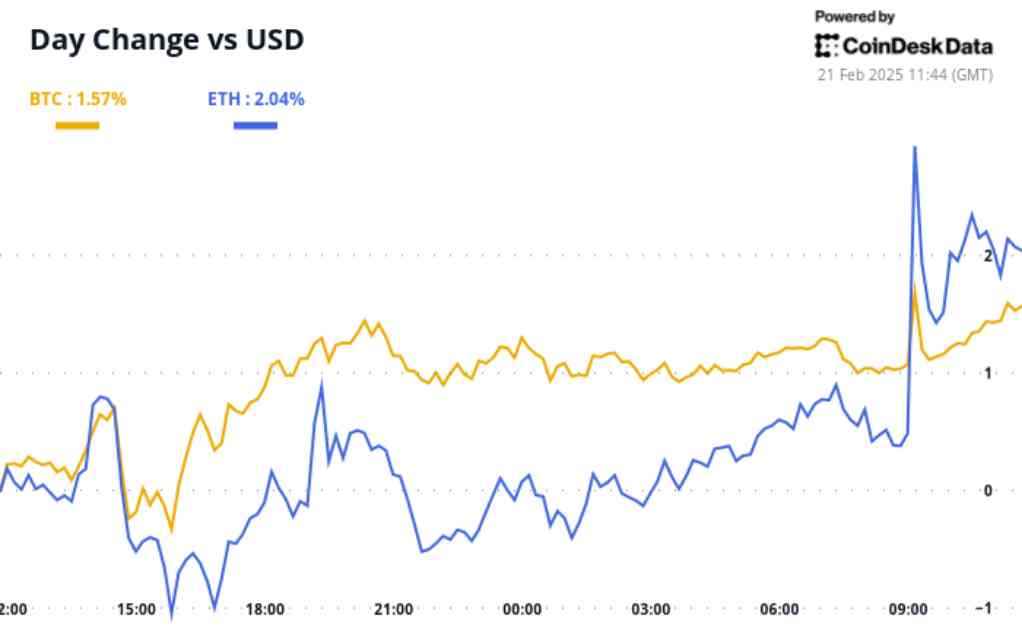

Bitcoin has surged above $98,000, recording a 1.2% increase in a 24-hour period, while the broader CoinDesk 20 Index also experienced a 1.35% rise. Despite this positive momentum, volatility remains relatively subdued. Jake O, an OTC trader at Wintermute, emphasized that periods of low volatility are typically short-lived, with volatility tending to revert to the mean.

Amid escalating tensions between the U.S. and its European allies, all eyes are on Germany’s upcoming election, set to take place on Sunday. Investors are hopeful that a stable coalition government in Germany will drive economic reforms to stimulate growth and increase defense spending. Germany, as Europe’s largest economy, holds significant influence over the region’s economic landscape.

As the crypto market anticipates the election outcome, open interest has already begun to rise. However, JPMorgan analysts caution that the market currently lacks positive catalysts in the near term. The prospect of backwardation, where spot prices exceed futures prices, poses a potential challenge, indicating weakened demand among institutional investors utilizing regulated CME futures contracts.

Upcoming Events to Watch in the Crypto Market

As the crypto market gears up for key events in the coming days, here are some highlights to keep an eye on:

Crypto Events:

• TON (The Open Network) to become the exclusive blockchain infrastructure for Telegram’s Mini App ecosystem on Feb. 21.

• Testing of Ethereum’s Pecta upgrade on the Holesky testnet to commence at epoch 115968 on Feb. 24.

• Ethereum Foundation research team to conduct an AMA on Reddit at 9:00 a.m. on Feb. 25.

• Solana-based L2 Sonic SVM (SONIC) mainnet launch, known as “Mobius,” scheduled for Feb. 27.

Macro Events:

• S&P Global to release February’s (Flash) U.S. Purchasing Managers’ Index (PMI) reports on Feb. 21.

• Eurostat to publish the eurozone’s final consumer inflation data for January on Feb. 24.

Token Talk: Memecoin Madness and Market Trends

The world of memecoins witnessed a tumultuous week, marked by the launch of a token proposed by self-proclaimed Nazi Kanye West, now known as Ye. Castle Island Ventures partner Nic Carter declared the memecoin craze as “unquestionably over,” a sentiment reinforced by reports of West’s plans to introduce the YZY token, of which he will own 70% of the supply.

Despite the memecoin frenzy, the broader crypto market remained relatively unfazed, with ETH and LTC seeing a 3% increase while TRX surged by 7.7%. Notably, NEAR emerged as a frontrunner, experiencing an 11% spike following the announcement of the “first truly autonomous” AI agents capable of managing assets on-chain.

Derivatives Positioning and Market Movements

BTC open interest on centralized exchanges has risen by nearly 5% to $37.3 billion, indicating a potential short squeeze scenario as funding shifts from positive to negative. Short liquidations dominated the futures markets, totaling $110 million compared to $6.11 million in longs.

Among assets with over $100 million in open interest, Maker DAO, Virtuals Protocol, and Artificial Super Intelligence recorded the highest one-day increase. In options trading, the call option on BTC with a strike price of $99,000 and expiring on Feb. 22 saw the most volume on Deribit, reflecting optimistic sentiment in the market.

In Summary

As the crypto market navigates through evolving regulatory landscapes and market dynamics, investors and enthusiasts remain vigilant for upcoming developments and events. The impact of key players, such as Kanye West’s foray into memecoins, underscores the ever-changing nature of the crypto space. Stay tuned for more insights and updates as the market continues to evolve.