The USDC Stablecoin Market Cap Soars to Over $56 Billion

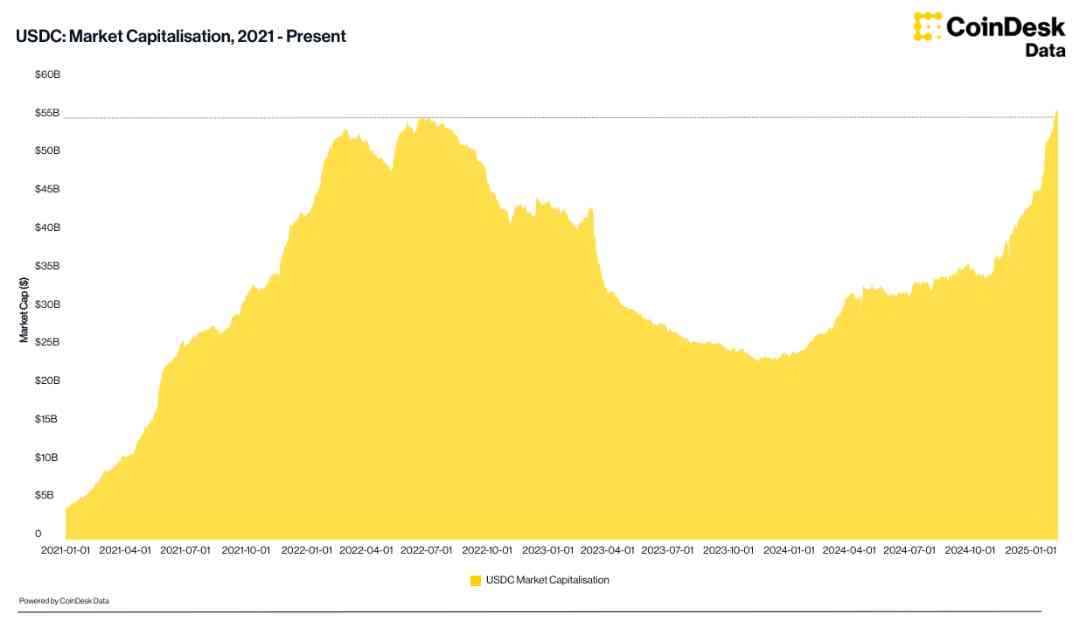

In recent weeks, the USDC and USDT stablecoins have seen a surge in minting activity, signaling a bullish trend in the crypto markets despite some fluctuations in token prices. As of February 12, 2025, at 7:03 p.m. UTC, Circle’s USDC, the second-largest stablecoin in the market, achieved a record market capitalization exceeding $56 billion. This significant milestone comes as the growth of stablecoins appears to be gaining momentum once again.

USDC, in particular, experienced a remarkable increase of $10.2 billion in its market cap over the past month. This surge was primarily driven by the rising trading volumes of Solana-based DeFi platforms, as indicated by data from Artemis. In comparison, Tether’s USDT, the largest stablecoin in the market and a major competitor to Circle, saw a growth of $4.6 billion during the same period, less than half of USDC’s expansion. Despite this, USDT still holds the dominant position in the stablecoin space with a market cap of $142 billion.

Achieving its highest market capitalization to date, USDC has not only surpassed its peak in 2022 but also fully recovered from the 2023 U.S. regional banking crisis that significantly impacted the cryptocurrency. During that time, Circle faced challenges as a portion of its stablecoin reserves held in bank deposits at Silicon Valley Bank led to a temporary loss of peg to the U.S. dollar. This crisis prompted many token holders to switch to USDT, propelling Tether to exceed its 2022 peak market capitalization as early as May 2023.

Stablecoins are a unique category of cryptocurrencies that are pegged to external assets, often the U.S. dollar. USDT and USDC play a crucial role in facilitating trading on crypto exchanges and providing liquidity to the market. Therefore, the increasing supply of these stablecoins serves as a key indicator of investor demand and the overall health of the crypto ecosystem.

After a period of relatively subdued growth in December and early January, both USDT and USDC experienced an acceleration in minting activity in recent weeks. Historical data suggests that previous surges in stablecoin growth, such as those observed between late October and early December, and from October 2023 to April 2024, coincided with significant rallies in the prices of bitcoin (BTC) and other altcoins.

While stablecoin growth is just one of the many factors influencing the crypto markets, it does provide a positive signal regarding the overall health of the market amidst macroeconomic challenges and price consolidations. As Krisztian Sandor, a U.S. markets reporter specializing in stablecoins and tokenization, emphasizes, the expanding market cap of USDC and USDT reflects ongoing investor interest and confidence in the crypto space.

Krisztian Sandor, a graduate of New York University’s business and economic reporting program, brings a wealth of expertise to the discussion on stablecoins and real-world assets. Holding investments in BTC, SOL, and ETH, Sandor’s insights shed light on the evolving landscape of digital currencies and their impact on the broader financial markets.