The cryptocurrency market is a volatile landscape where traders tread carefully, especially when it comes to altcoins like XRP and DOGE. As Bitcoin’s dominance reaches a four-year high, the XRP short bias persists amid hopes for a favorable legal outcome for Ripple. Meanwhile, DOGE teeters on the edge of a concerning technical pattern known as the death cross.

XRP’s Uncertain Future Amid Legal Battles

In the realm of cryptocurrencies, XRP has been a focal point of attention due to its connection with Ripple and the ongoing legal battle with the Securities and Exchange Commission (SEC). As XRP’s price sees a modest rise to $2.24, traders are closely monitoring the developments in the legal saga, hoping for a resolution that could potentially impact the coin’s future.

Data from Velo indicates that XRP’s open interest in perpetual futures remains near 1.35 billion XRP, with funding rates and volume delta in negative territory. Negative funding rates suggest that shorts are paying fees to maintain their bearish positions, reflecting a prevailing sentiment of skepticism in the market. The negative volume delta further reinforces the bearish trend, hinting at a potential downturn in XRP’s price trajectory.

DOGE’s Looming Death Cross Spells Trouble

On the other hand, Dogecoin is facing a technical predicament as its 50-day simple moving average (SMA) threatens to cross below the 200-day SMA, forming the ominous death cross pattern. This pattern, although not a definitive indicator, often signals a shift in momentum from bullish to bearish, prompting traders to brace for potential selling pressure.

Despite DOGE’s recent decline of 65% from its December peak, the confirmation of the death cross could trigger further downward movement in the token’s price. While SMA crossovers are historical indicators and not foolproof predictors of future price action, they serve as cautionary signals for traders navigating the volatile cryptocurrency market.

Bitcoin Dominance Surges to New Heights

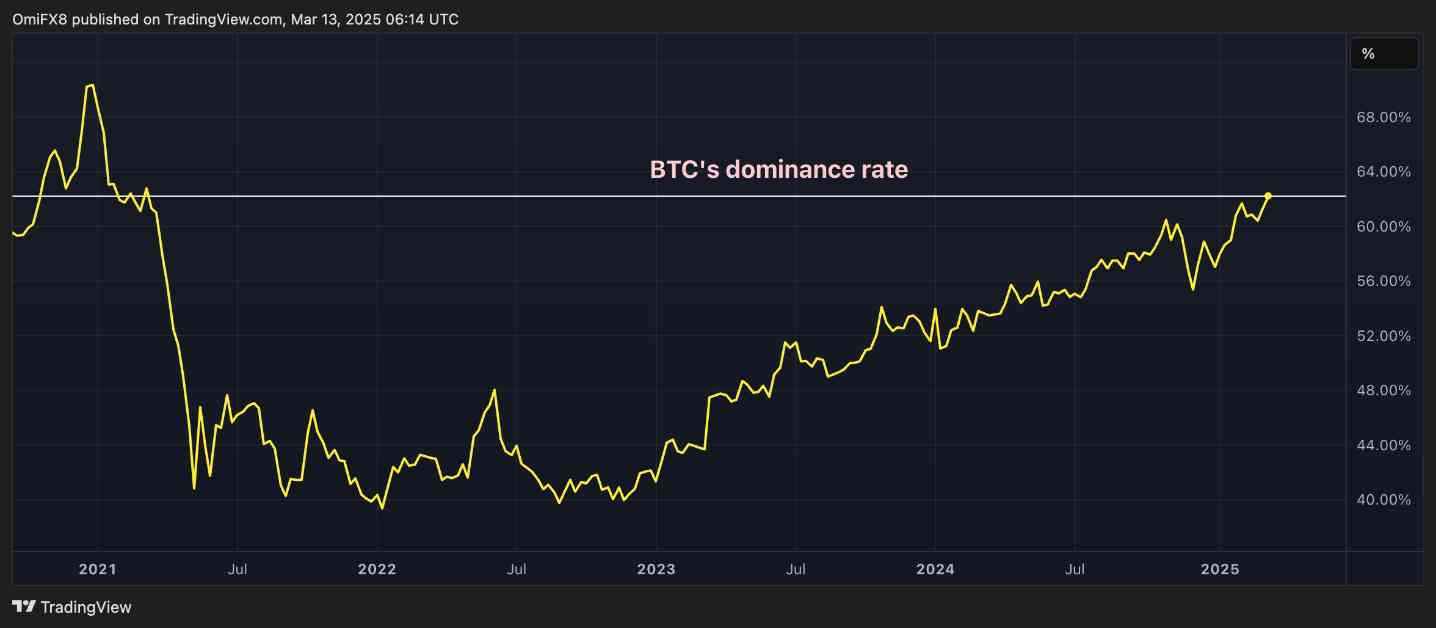

Amidst the uncertainty surrounding altcoins, Bitcoin’s dominance rate has soared to 62.5%, marking its highest level since March 2021. This uptick in dominance reflects a broader trend of investors flocking to Bitcoin during market downturns, seeking stability and security in the leading cryptocurrency.

As Bitcoin’s dominance continues to rise, traders are closely monitoring its performance as a barometer for market sentiment and risk appetite. Omkar Godbole, a Co-Managing Editor on CoinDesk’s Markets team, highlights the significance of Bitcoin’s dominance rate as a key indicator of market dynamics, shedding light on the evolving landscape of the cryptocurrency market.

In conclusion, the cryptocurrency market remains a dynamic and ever-changing environment where investors must navigate through a myriad of factors to make informed decisions. With XRP’s legal battles, DOGE’s technical challenges, and Bitcoin’s dominance reaching new heights, traders are faced with a complex and nuanced landscape that requires vigilance and expertise to navigate successfully.