Acorns clients now have the option to allocate up to 5% from their funds into BITO.

Acorns customers can add Bitcoin exposure to their portfolios

Acorns , a U.S. fintech firm, detailed Tuesday that there has been increased demand for cryptocurrency investment. The micro-investing and robotics business is based in Irvine, California. Acorns launched ten year ago by father-son team Walter Wemple Cruttenden Jr. and Jeffrey James Cruttenden. Statistics show that Acorns had $3 billion in assets under management (AUM), and 8.2 million customers in 2020.

The announcement made Tuesday by the fintech company stated that the company decides how much of a customer’s portfolio can go into the Proshares Bitcoin Strategy (NYSE: BITO). Noah Kerner, chief executive officer of Acorns, stated that there are two options for portfolio exposure. One is a conservative option with a maximum of 1% and one that allows for aggressive exposure. The other option gives a portfolio with a maximum of 5%. Kerner said that approximately 4.6 million customers of Acorns have not yet invested in digital currencies due to a lack of knowledge.

Kerner stated, “We are really trying to drive home diversification and long-term investing principles,”

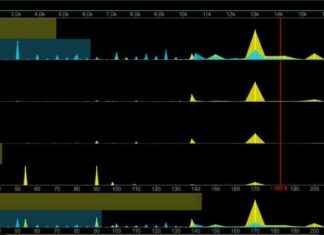

Kerner said that customers haven’t invested in digital currencies due to volatility. Proshares Bitcoin Strategy ETF currently trades at $26.91 pershare and is down 37.88% compared to its $43.32 all time high (ATH), on November 9, 2021.

Kerner stated, “Something like Bitcoin or any volatile asset type, it’s fine to have exposure to but it should be through a lens of a balanced portfolio.”

Acorns secured $300 million in financing from strategic investors. This round was led by TPG. The company’s value has risen to $1.9 billion due to the capital injection. Over the past 12 months, robo-investing and microinvesting firms have been shifting towards cryptocurrency investments. This includes companies like Betterment and TD Ameritrade Wealthfront Inc.